Will ChatGPT take down Google?

Feb 09, 2023Price Target: Unlock 🔐

Target Date: Unlock 🔐

Stock: Alphabet ($GOOG)

Last week we saw the majority of big tech companies take a big hit on the back of reduced demand and reduced ad budgets.

Meta got boosted on simply not completely collapsing, Apple escaped because of a future outlook, and Amazon got smashed because its cloud program simply isn't growing fast enough to justify its valuation.

But out of all of these, potentially the most outsized and unjustified reaction was the small slide we saw in Alphabet ($GOOG) stock.

On the surface, this was due to a reduction in ad budgets that are impacting GOOG's bottom line. Additionally, there are worries that we could dip a little further into a recession and kill the kind of ad revenue keeping Alphabet afloat right now.

However, looking at the straight, sober fundamental analysis, Alphabet is looking fairly oversold compared to similar underperforming quarters.

A lot of this is most likely due to the ongoing hype surrounding tools like ChatGPT and AI's potential to "disrupt" the search space.

The majority of posts, columns, and narratives coming out of the sudden ascendance of OpenAI centers around the assertion that ChatGPT "just ended" Google.

The short response to this assertion is simple: that's ridiculous.

While there are still some risks that tools like ChatGPT pose to Google -- it's just those threats actually are coming from within Google itself instead of from any product that OpenAI could release in the next few years.

Furthermore, the market's perception that Google's new AI is inferior to Microsoft's new ChatGPT-powered Bing homepage is absurd.

Google is growing at the right pace and finding actual use cases for its LaMDA architecture instead of burning a pile of cash chasing a trend before they find a solid revenue base for it.

So, let's look at how Alphabet can grow in 2023 and more importantly why the current pressure being placed on GOOG stock isn't really rational and therefore something we can take advantage of.

Let's get into it 👇

Google's Tough 2023:

It's tough to start this without acknowledging that Alphabet stock is down 26% since peaking during the end of 2021 mania.

It's not down nearly as bad as other tech giants but is still facing weaker prospects for the first half of 2023.

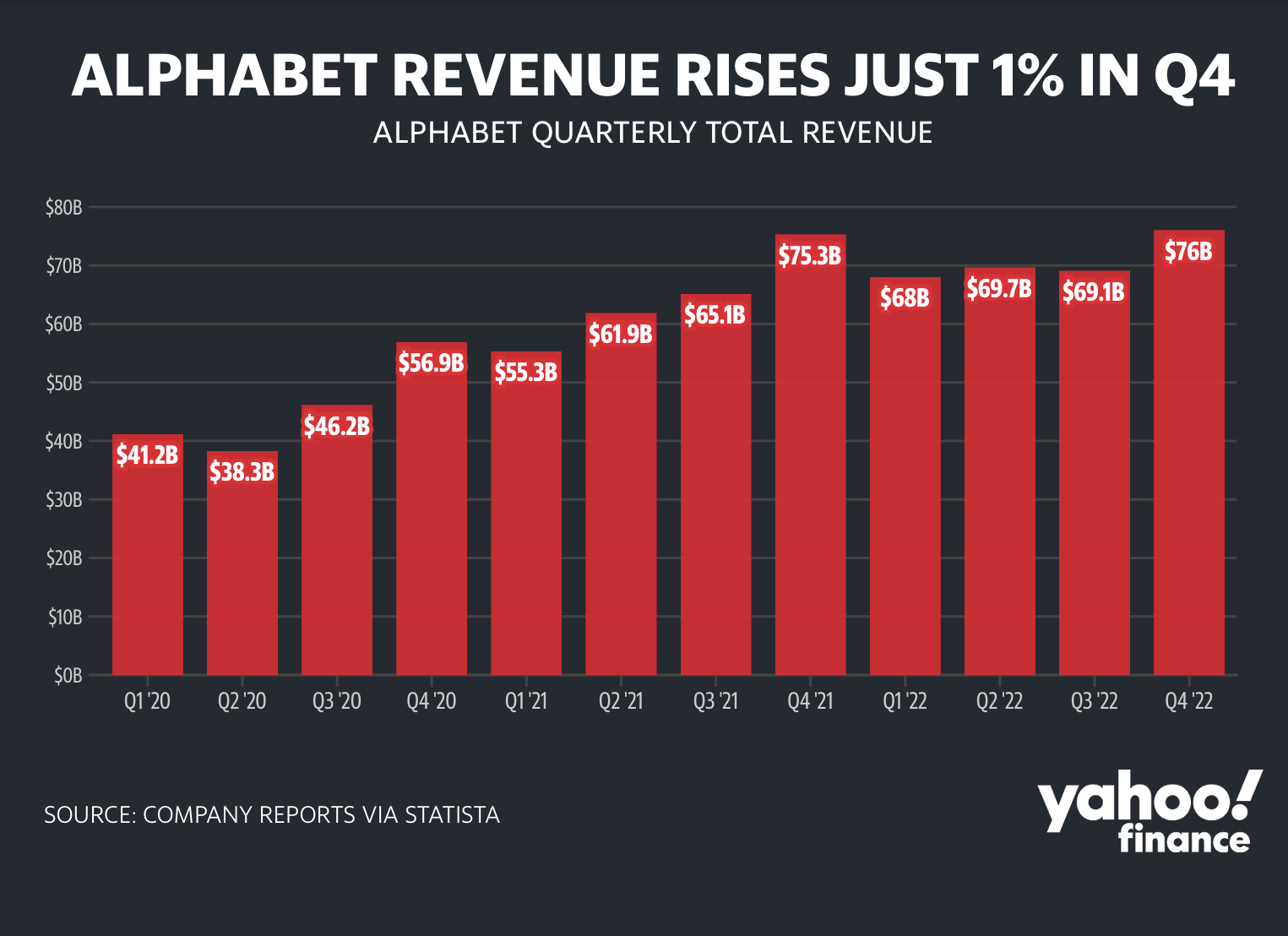

That being said, Google is honestly looking really strong to start off 2023. The stock is down this week because they simply did not grow revenue enough to meet the street's expectations.

And despite the slowed growth, this was still a record quarter for Google.

More importantly, there was no standout area of decreased growth over at Alphabet. All the biggest revenue drivers grew slower while, amazingly, Google Cloud had a mild breakout revenue beat.

When it comes to these big tech reshufflings, we actually like these results because we can explain why ad revenue is down across the board. Small and medium businesses got hammered in the last few months by inflationary pressure and depressed ad revenue.

With Jerome Powell acting more and more dovish on rate raises, we're confident we can start seeing a recovery across a lot of the economy by H2 of 2023 -- setting Google up for a big revenue beat by their Q3 earnings call.

Moreover, Google Cloud is #3 on the charts when it comes to change in spend according to industry surveys, meaning that the same forces keeping Microsoft Azure aloft are also buffeting Google.

However, even these mild revenue beats have an outsized effect on Alphabet because of how comparatively small Google Cloud is.

This is why Amazon is in a bad place -- AWS simply is too important for their overall bottom line. Google can keep these mild accelerations going despite reduced cloud spend and keep buffeting their declining ad sales while the same level of industry spend strangles our hopes for Amazon.

So, the fundamentals here look great. So that begs the question: Why are we so contrarian to the rest of the media when it comes to AI and ChatGPT messing with Google's bottom line?

Will AI Kill Google?:

This comes down to scale.

ChatGPT is the fastest-growing product in the history of the world, hitting a million users in its first week.

But that scale hides how insanely expensive ChatGPT is to use. It also hides the actual utility of Large Language Models like what OpenAI is building off of -- but we'll get to that in a second.

This is capitalism, we don't care about how useful something is. We care about how profitable it can be. And ChatGPT has a huge money pit at the center of its operation.

The computing power required to return a single query from ChatGPT (probably) costs ~2 cents on average. That sounds cheap enough until it's compared to the cost of a single google search -- which estimates put at ~0.35 cents on average.

TLDR: ChatGPT is nearly 8x more expensive to operate than Google.

From a scalability standpoint, the two are pretty hard to compare. OpenAI will probably have a solid run with their $20/month ChatGPT Plus product (as long as a sizable majority of users don't push past 1,000 queries a month I mean), but that immense disparity adds up to a diminished threat to Google search's dominance.

However, it's important to keep in mind that Google is currently working on its own AI products -- even Large Language Models like OpenAI.

This week, Google's stock popped a little when they announced their response to Chat GPT, Bard, was being opened to a limited beta before getting a wider public release.

Bard is powered by Google's LaMDA architecture -- which you may remember getting a little press last year when an ex-Google employee asserted that it was 'sentient' (spoiler alert: it's not).

This LaMDA release is honestly a gamble.

In the short term, we'll see positive pressure on Google's stock price, but we are going to watch their next few earnings releases with the worry that the expense of AI queries could compress Google's margins to a degree that would kill our 2023 bull thesis.

The market would temporarily hype it up, but it would be a medium-term detriment to Google's overall product health.

Google has announced they are being more efficient in 2023 and since they own all their own servers, the costs for Bard won't be as steep as they will be for ChatGPT.

The thing we need to see to be completely sold on utilizing AI at Google is them further integrating Bard and AI into Google search itself -- the way it already does with smart snippets and the like.

So, long story short, Google is in a strong position because its product is so much more scalable than ChatGPT can be any time soon.

Alphabet Outlook:

The most important thing to realize about Alphabet is that they are prepared for a wider recession already.

They pre-loaded their layoffs and office contractions despite the fact we're not (officially) in a recession yet.

Sure, it sucks that Google over-hired during the mania of 2021, but if the macro environment keeps declining, it will not hurt their revenue growth much more than it already has.

That's the core of our bull thesis, Google is at a fundamentally cheap and efficient level that will make the margin growth they need to satiate the market relatively easily.

Furthermore, the actual threats to Google right now are the two antitrust lawsuits looming over the company.

There are a lot of ways those can play out -- some of which would actually be beneficial to shareholders in the long term. But more importantly, it will take a long time for those suits to play out.

In the medium term, we can take advantage of an artificially compressed valuation to initiate a position in Alphabet at a solid discount. Frankly, this is too good an opportunity for us to pass up at the moment.

2023 is already taking shape as a volatile-yet-hopeful year. We're really excited to see how Alphabet and the rest of Big Tech take to navigating it.

Risk/Reward: Medium-High / High

Rating: Overweight

Dividend Yield: N/A

Market Cap: $1.3 Trillion