BlockFi: Don’t just buy crypto - here's a way to sit back and earn it

Nov 02, 2021With so much speculation around investing in stocks, NFTs, crypto, and other markets, many professional investors are calling for a pullback at some point.

And even if this pullback never comes, many investors are looking for a lower risk place to park their assets while still earning some upside.

The choices for most people are extremely slim.

Either you stick your money in assets that fluctuate in value or you keep your money in cash/fixed income, that pay you next to nothing. For example, checking accounts with most major banks in the US are paying less than a .03% interest rate which equates to 3 cents paid per $1,000 held annually - aka basically 0 as that doesn't even keep up with inflation.

By keeping your cash in these types of accounts you're actually losing money every year as inflation outpaces your return and your dollars are worth less and less.

With poor options elsewhere many investors often over-extend their portfolio in order to see some sort of return on their money. But rising in popularity is a third option most people don't even know of.

And that is interest bearing crypto accounts.

Never heard of them?

These types of accounts pay up 10% annual interest just for you holding your excess cash/crypto with them!

So what are these accounts, where do you access them, how do they pay 10% annually and are there any risks? Let's get into it 👇

Interest Bearing Crypto Accounts:

So before we dive into where to access them, we need to explain further what these accounts are and how they work. Skip to the section, "Introducing BlockFi" if you're already familiar with this and are looking for the best interest-bearing crypto accounts.

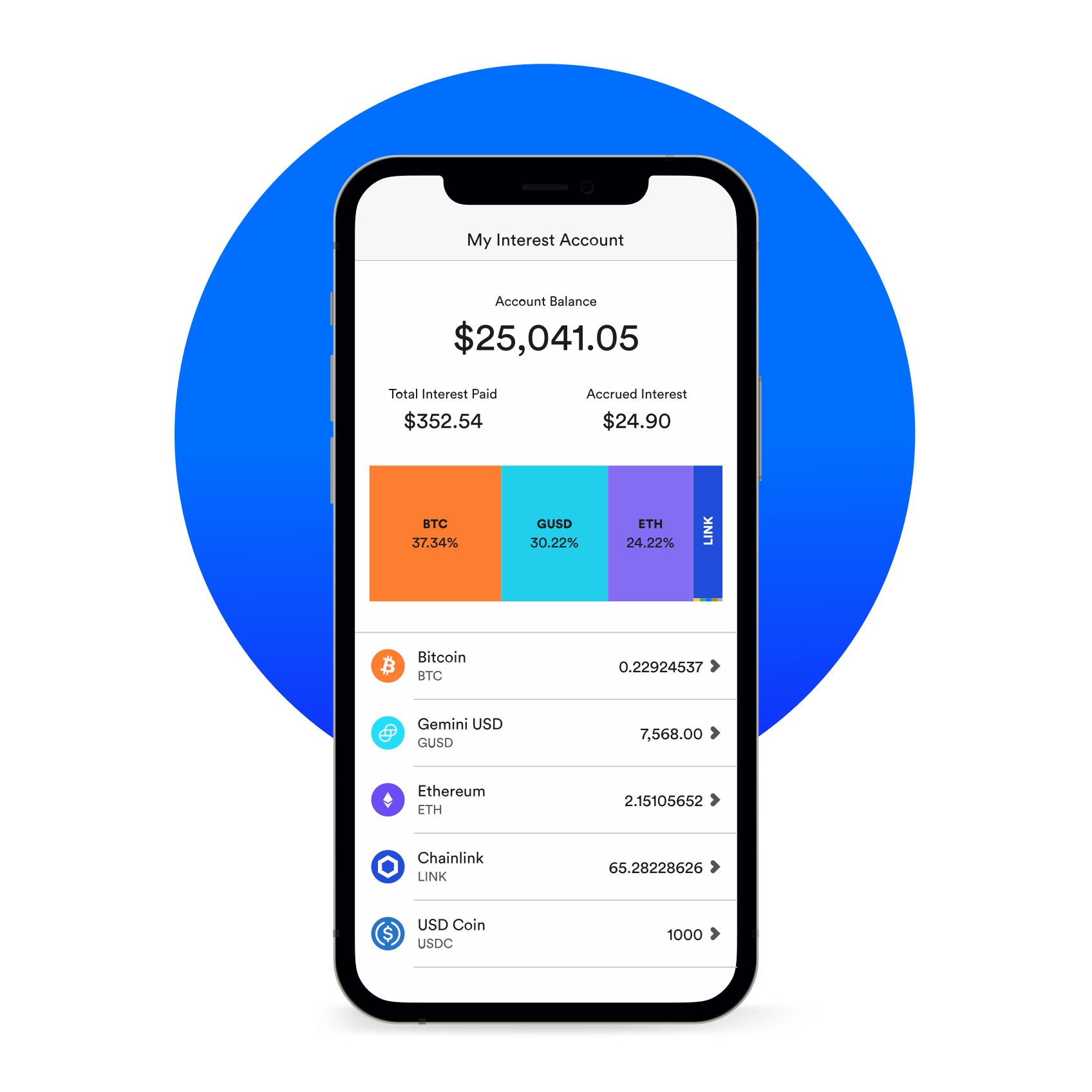

So, interest bearing crypto accounts are quasi-like checking accounts where certain institutions will pay you up to 10% annually just to hold your crypto/cash with them.

That means that for every 1000 dollars you put into the account you get nearly $100 back every single year. Let's pause there for a second and remember what we just discussed above.

We just said that most banks are paying you 3 cents while a crypto interest account will pay you $100 annually.

That is absolutely insane! Let's dive into how you can earn interest below.

How it works:

If you go to a bank and deposit USD or another currency there, the transaction is pretty straightforward. You deposit money into your bank account, they hold onto it and they pay you small amounts each year with little to no risk (depending on which country you live in).

With these accounts however, rather than putting in fiat currency, you need to swap your fiat out for the crypto Stablecoin equivalent. If you're not familiar with Stablecoins, the high level concept isn't new.

Stablecoins are just cryptocurrencies where the price is designed to be pegged to some fiat currency (this exists in many places outside of crypto). In the case of what we're suggesting that pegged fiat is the US dollar.

Therefore once you swap out your USD for the Stablecoin equivalent, you're just holding a crypto asset that doesn't really fluctuate and stays stable (hence the name). While this in itself comes with some risk, the purpose of this analysis is just to cover the crypto interest rates (we'll publish another analysis soon on Stablecoins themselves).

Once you've swapped it out, you can use this crypto interest account to earn some serious income. Below is a quick example of how this compounds over time.

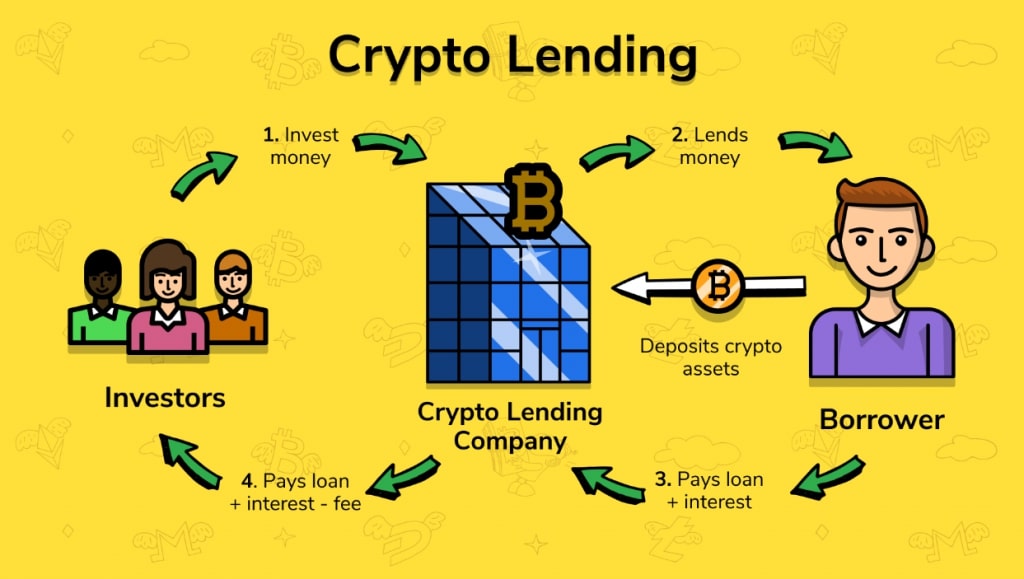

An infographic on how it works at a high level

Income Potential:

Year 1: You put in $10,000 and earn 10%. Therefore at the end of year 1 your balance is $11,000 ($1,000 in annual interest).

Year 2: Your starting balance is $11,000 and you earn 10%. Therefore at the end of year 2 your balance is $12,100 ($1,100 in annual interest).

In this example because your base is higher, you earned more income on your principal. While in the early years, this doesn't amount to massive differences, over time this truly adds up.

After only 10 years, instead of earning $1000 a year, you're already at $2,593 in annual interest. This concept also isn't new but with such a higher interest rate, the compounding effect makes a huge difference, very fast!

Introducing BlockFi:

So you may be wondering to yourself, "How this is even possible? How do these accounts afford this interest payment when Chase and other large banks pay out less than 1%? Who should I even use for this?"

While every company does it differently, the best solution we've come across so far is BlockFi.

BlockFi does this by lending out your coin to other corporations and in exchange, these corporations pay them a substantial fee which they redistribute out to their customers.

With all this leverage you would think the risks are truly high but they counteract this via something called over-collateralization.

Over-collateralization is when corporations are required to overpay (aka over-collateralize) their loans so they actually pay a lot more than what they give. For example, if they want to borrow $100 they put down $200 for the loan application.

Therefore if the loanee is paying 2x what they borrow then the risk for many of these accounts is low given the financial status of the crypto loan corporation. And if they don't pay back, then the deposit should cover their default. BlockFi also has a risk management system that will deny and monitor any bad actors on their network.

BlockFi's platform is pictured above

Risks:

While this all sounds amazing in principle, there are certain risks that you get with these accounts that you don't get with a bank. For example, you do not get FDIC insurance or other US regulatory coverage. So if BlockFi defaults you lose 100% of your principle whereas if a bank were to default, the US gov would step in and cover your losses up to $250k.

Therefore it is not guaranteed by the US government which can be a substantial risk.

However, BlockFi tries to mitigate these risks by working with a third-party custodian. This custodian is Gemini who is owned by the Winklevoss twins.

Their custodial services store these funds on the Gemini cryptocurrency exchange and while this also isn't FDIC insured it is licensed by the NYS Department of Financial Services. They also recently received their SOC 2 Compliance by Deloitte which is a very big deal and they're one of the only exchanges in the world to get this.

The reason Gemini is so secure is that 95% of its funds are held in cold storage.

BlockFi also isn't just a random company but has been around and is backed by huge financial players like Fidelity, Sofi, etc.

So while there is some risk for sure, it is relatively manageable with sizable returns. If you're looking for a place to park your excess cash or just don't want to take on much risk right now, this is a great alternative in a low interest rate environment!

How to get started:

If you want to get started be sure to check them out below. They're running a promo right now where they'll give you $10 of Bitcoin for Free!

Just click the link here to learn more: Get Started

If you have any questions, please email us!