Can CVS Beat Amazon?

Feb 21, 2023Price Target: $107 (21% upside)

Current Price: $88

Target Date: Q1 2024

Stock: CVS Health ($CVS)

One of the bigger narratives we've been watching materialize in 2023 is this new battleground brewing over healthcare.

It's no secret that healthcare in the US is inefficient and ripe for disruption. Last year we discussed how a few key acquisitions by Amazon were the start of a major battle for who will control the future of healthcare in the US.

Well, the second major player in that battle has finally put all its primary pieces together: CVS Health ($CVS).

CVS just blew up on a brilliant earnings call that came right after their bombshell acquisition of Oak Street Health.

CVS has picked its segment as it pushed further and further into being a full-stack healthcare provider: Medicare.

Oak Street is a Primary Care Provider for medicare recipients -- making a critical third pillar for CVS's ambitions for local healthcare dominance.

Medicare is a brilliant angle to take, especially as we roll toward the 2030s. But the cohesive nature of CVS's entire strategy is the reason we're initiating a bullish position today.

We're not completely out on Amazon either, but CVS has a growth path that's really hard to ignore going into the next 5 years.

The only major risk here is how expensive the Oak Street Health acquisition is moving forward -- but we'll get into that.

We've got a lot of details to cover, so let's just get straight into it 👇

CVS Health Overview:

Slowly but surely over the last 5 years, CVS has become a dominant force in healthcare. You might be aware of the pharmacy chain, but their reach goes far wider than that.

First up: 85% of all Americans live within 10 miles of a CVS store.

That's a wild statistic to read -- especially when this article is being written in a coffee shop across the street from a CVS location.

Second, it's way more than a store. CVS took a page out of the Best Buy and Lululemon playbook and supported their retail store spread by allowing those stores to be hubs for a massive healthcare business.

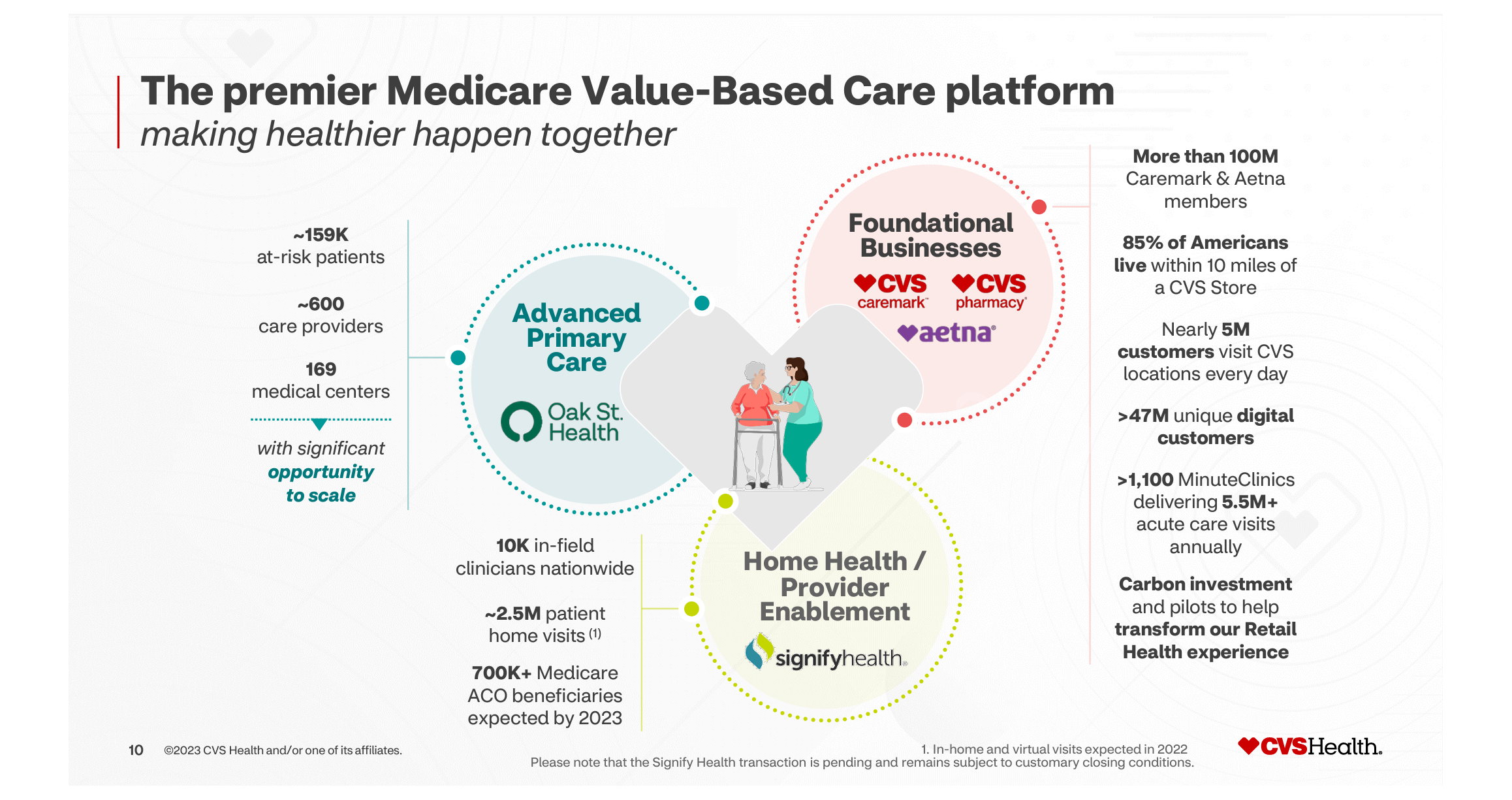

CVS also owns CVS Caremark, which is a pharmacy benefits manager, Aetna insurance, and home health provider Signify Health.

We'll get into how Oak Street slots in as a critical third pillar here in a second, but let's make sure we have a good sense of the foundation here first.

CVS has been working hard for the past 5 years to find a way to own a holistic relationship with its patients.

One of the big things creating the expense and inefficiencies in healthcare is how fractious the industry is and the executive team at CVS has been working hard to try and own every aspect of the patient/care relationship.

This consolidation creates efficiencies that allow CVS to cut costs while bringing in more revenue.

More importantly, the human body is the most complex machine in the known universe.

Just growing up and going to the doctor and taking care of yourself creates an astounding amount of data. And all of those data points can be leveraged to create better care pathways.

That data is also extremely valuable.

That's going to be core to any move in this new consolidating healthcare space -- e.g. finding ways to leverage patient data as they cross from platform to platform to produce better outcomes without having to resort to passing onerous costs onto the consumer.

Building a system like this is really expensive though and really mistake-prone. That's why we like CVS's push into Medicare here.

While they build this unified patient care ecosystem, they're starting in an area where consumers have more money and there is government funding to rely on.

Furthermore, despite two years of rising costs, CVS has done a bang-up job of establishing its foundation so far:

Cash Ffow being down is a little concerning, but understandable given the supply chain pain we've had to deal with.

Furthermore, we don't see it as an ongoing issue because CVS is staying committed to its ludicrous 2.7% dividend.

All in all, this is a great ground floor for the CVS team to build on top of. So what are they building, exactly?

The Oak Street Health Acquisition:

A few weeks back, CVS announced the all-cash acquisition of Oak Street Health -- a Medicare Primary Care Provider.

CVS already has a lot of experience servicing Medicare patients via the Signify Health subsidiary, so this acquisition was kind of a no-brainer.

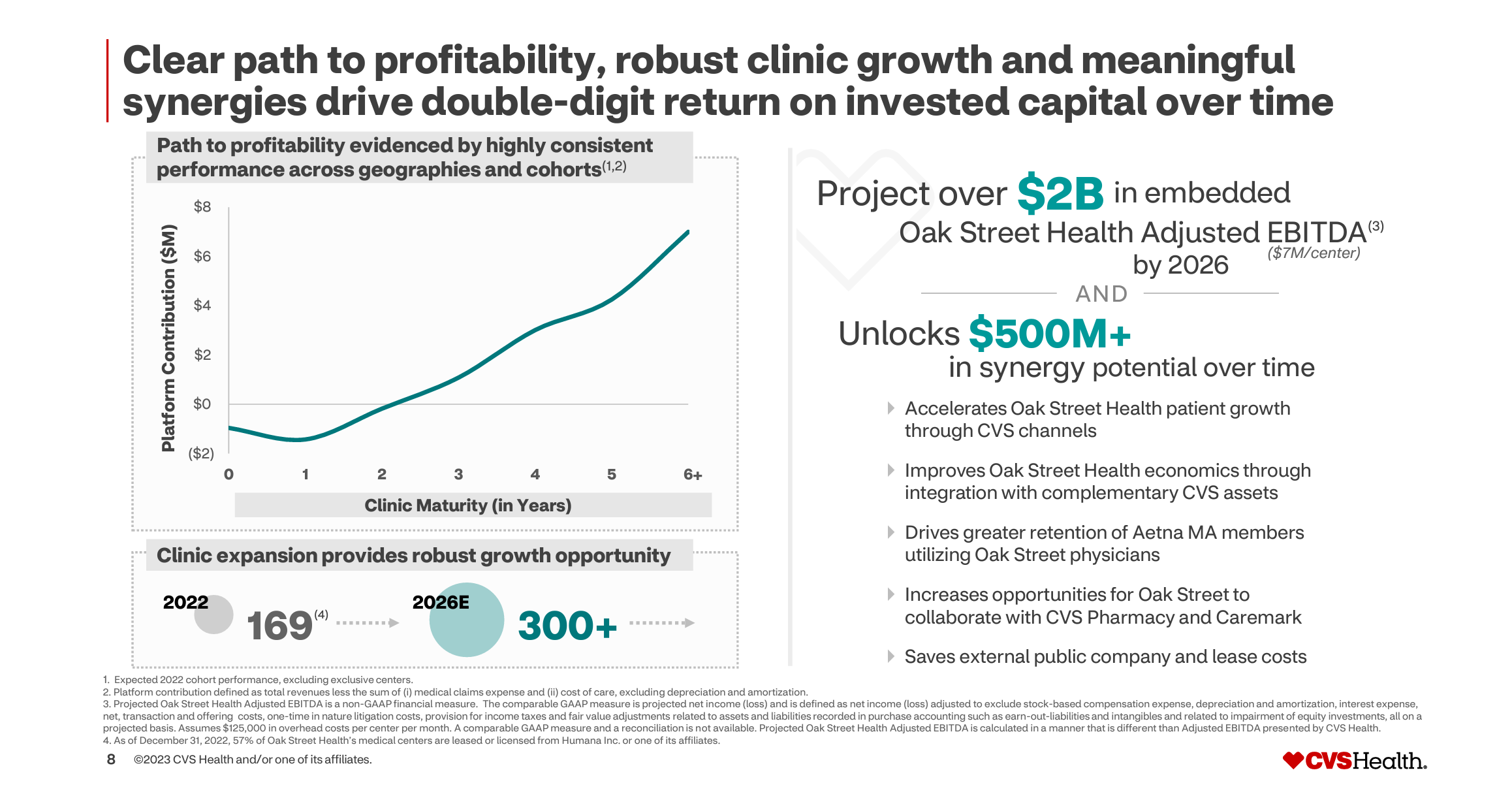

Oak Street is active in 20 states and expanding fast, and combined with the other healthcare arms of the CVS empire, they're set to basically explode across the next 3 years:

Oak Street is already so close to a healthy level of profitability that the efficiencies created by joining CVS will allow their executive team to nearly double the number of Oak Street clinics in the next three years.

As each clinic hits maturity, they effectively become cash volcanoes as Medicare patients have consistent and predictable needs as they advance in age.

That's the second part of why CVS is picking the smartest route here: Medicare enrollment is (conservatively) expected to expand by nearly 60% by 2030 going to over 80 million Americans using the program.

America's biggest generation of all time is getting older, and a huge amount of our healthcare resources are about to be spent managing their golden years.

CVS is starting as a medicare-first full-stack healthcare provider in order to capture this explosive patient growth, utilize a more cash-heavy generation as their proving grounds as they iron out the kinks, and then use the most difficult kind of patients to take care of to build a cohesive ecosystem for younger, healthier patients.

You couldn't time this more brilliantly, and their 3 pillar growth path just makes a lot of sense in this environment:

Oak Street and Signify Health will feed into each other's value propositions, and the learnings that come from both with provide critical insights for the core CVS Health and Aetna platforms to build new PCP platforms for other patient types.

That's the long-term vision.

In the short term, CVS has established itself as a profitable juggernaut that will dominate healthcare as we enter into one of the most expensive periods of healthcare in human history.

It's that consistency that's going to make CVS really valuable.

CVS Outlook:

In the end, CVS is definitely more of a long-term play.

We're really excited for them to complete the Oak Street Health acquisition in 2023 and can't wait to see how they consolidate operations and begin building a more cohesive healthcare platform.

Some of these efficiencies will take time to build, so we're probably not checking back in with CVS until early next year.

Regardless, you can't go wrong with their growth path and ridiculous 2.7% dividend.

We're really excited to see where they take this from here.

Rating: Overweight

Market Cap: $113B

Dividend Yield: 2.7%

Risk/Reward: High / High