Desktop Metal: Future Leaders of 3D Printing and Manufacturing

Mar 11, 2021Headline:

Today we are initiating coverage on a new stock, Desktop Metal (DM). Desktop Metal (DM) is technology company that designs and markets 3D printing systems. They've raised over $500M before going public from some of the largest venture capitalists in the world. Their technology is aimed at solutions for every stage of the manufacturing process - from prototyping and pilot runs to mass production and aftermarket parts. They are truly reinventing the way engineering teams produce metal across a wide range of applications and industries. While not a household name, this company is changing the game in 3D printing (which is a huge area we have and continue to be bullish on). Additionally this is another "Chamath" stock which many investors have been following extremely closely. Let's break it down further.

Background Information:

So before talking about Desktop Metal (DM), let's discuss what 3D printing really is, why it is important and what Desktop Metal (DM) is doing about it.

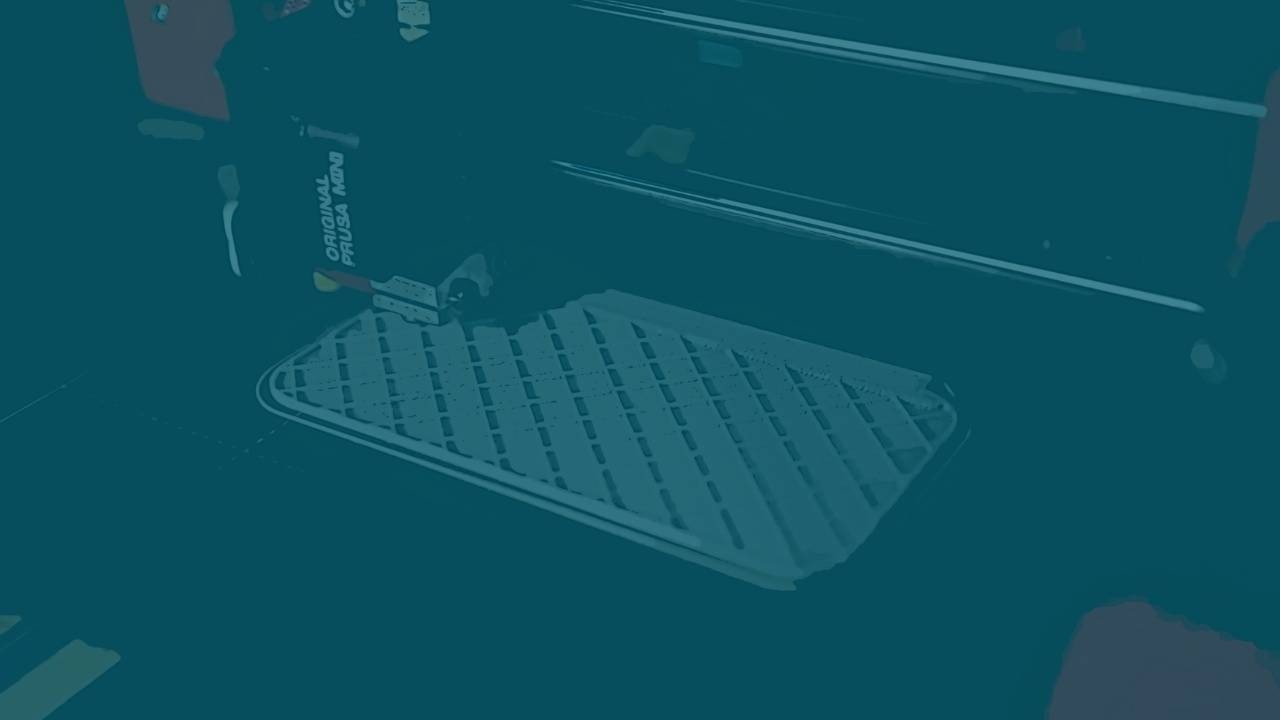

3D printing is an innovative technology that lets you create a physical object from a digital model. All you need to do is make a design, transfer the file to a 3D printer, then bring your object to life. Once printed, the 3D printer produces layers of material, one on top of the other. This forms the finished object. So for example instead of manufacturing traditional hardware, 3D printers can recreate the same finished products by designing it on a computer and just clicking print! Think of it similar to a traditional printer but instead of 2 dimensional it is 3 and can use other materials (not just ink - it can use metal, graphite, etc.)!

So why is this so revolutionary? 3D printing is so revolutionary for a few reasons:

- Speed: Companies can now build prototypes and innovate faster than ever. Rather than using traditional means of manufacturing, with 3D printing companies, they are able test their ideas in real time and make changes faster than ever. By doing this, companies can rapidly increase the speed at which they bring new ideas to market and quickly validate/invalidate ideas.

- Cost: Compared with traditional means of manufacturing, the cost of printing objects is significantly cheaper and more efficient. Layer in the saved labor costs and the cost of innovating and scaling products can now be cheaper than ever!

- Quality: During the manufacturing process, error can easily be introduced that gets amplified and can lead to catastrophic consequences. With 3D printing, you remove all of the manor labor and introduce new efficiencies that make products not only higher quality, but safer too!

- Sustainability: Similar to the above, traditional manufacturing creates significant waste and is improved via 3D printing. With also fewer parts, and more efficient designs, less energy is used too, creating a more sustainable, healthier and cheaper product.

While these are some significant benefits of 3D printing the list keeps going on. And now that we've broken down what 3D printing is and why it's important, let's get into what DM is doing about it!

Desktop Metal Details:

DM is specifically operating in and tackling the additive manufacturing sector. What is this? Our thesis is that additive manufacturing is the replacement of traditional tools to manufacture specific parts using new technology (such as 3D printing) to build anything quickly, safely and to scale. When thinking about the future of their space we see DM specifically being a disruptor for 3 reasons:

1) As innovations get rolled out, DM is in a position to test and validate these changes quicker than older manufacturing processors. This leaves DM ready to win the game of revenue costs and scale better than anyone else can.

2) As the world changes post COVID, there will be more of an emphasis on curtailing costs in the supply chain in order to maximize efficiency. This is where again DM can operate better than any of their peers. Additionally these costs can all be brought onshore and none of the labor needs to be brought outside of the US!

3) Output for DM results in the following relative to traditional manufacturing: a) 0 waste b) lower energy consumption c) Smaller manufacturing plants needed to replicate the same output

And not only do they have the opportunity to execute, they're proving they can. Let's take a look at the numbers:

- 2025 expected revenue $950M (represents over 100% YoY revenue growth relative to where they are today)

- 2025 expected EBITDA is $260M (representing net margins of 27%)

THIS IS UNHEARD OF FOR TRADITIONAL MANUFACTURING

Looking across their "competition" we see margins in the single digits and YoY growth in the single digits too. What this tells us is that DM is in a unique position to take significant market share from legacy players. When we see dynamic shifts like this unfolding, this becomes massive opportunities for us to partake in! While there are obvious risks (new entrants, anti-competitive practices, new laws, etc.) we're definitely watching out for DM in the long term!

Ticker: DM

Rating: Overweight

Price Target: $30 (represents ~50% upside)

Target Date: 6-10 Months