What's Driving Ferrari's INSANE Profits?

Feb 10, 2023Price Target: $317 (23% upside)

Current Price: $258

Target Date: Q1 2024

Stock: Ferrari ($RACE)

This macro environment is fairly complex to navigate. And that's because rising costs have different effects across industries.

Last week, we showed you how luxury branding doesn't seem to be helping major beauty brands keep up with e.l.f.'s meteoric rise.

However, in some sectors, luxury appears to be the ticket to explosive growth in 2023.

Nowhere is that more clear than one of our favorite car picks of the last year - Ferrari.

Last week, Ferrari posted gangbuster earnings that demonstrated what we thought was going to be impossible in this macro environment: their net profits grew on the back of solid add-ons and new models.

Additionally, RACE pulled off impressive growth in China which gives us confidence about the company having a truly strong and safe foundation for a potentially bumpy 2023.

Let's make this one quick -- how on Earth can Ferrari pull something like this off? 👇

Ferrari's Unbeatable Margins:

Profit is everything in this market and investors love nothing more than a solid margin.

And since Ferrari is the golden standard for luxury and status in the car space, they can basically charge anything for a car and their target audience will pay for it.

And so, Ferrari posted a truly wild 21% operating margin for Q4 and a 13% increase in profits for the full year.

What's wild is that a 21% margin for Q4 is actually down year-over-year as Ferrari released slightly more profitable ultra-luxury models last year.

But with rising materials costs and compressed supply chains, where did all these margins come from?

The answer is simple: Ferrari is ripping through new markets.

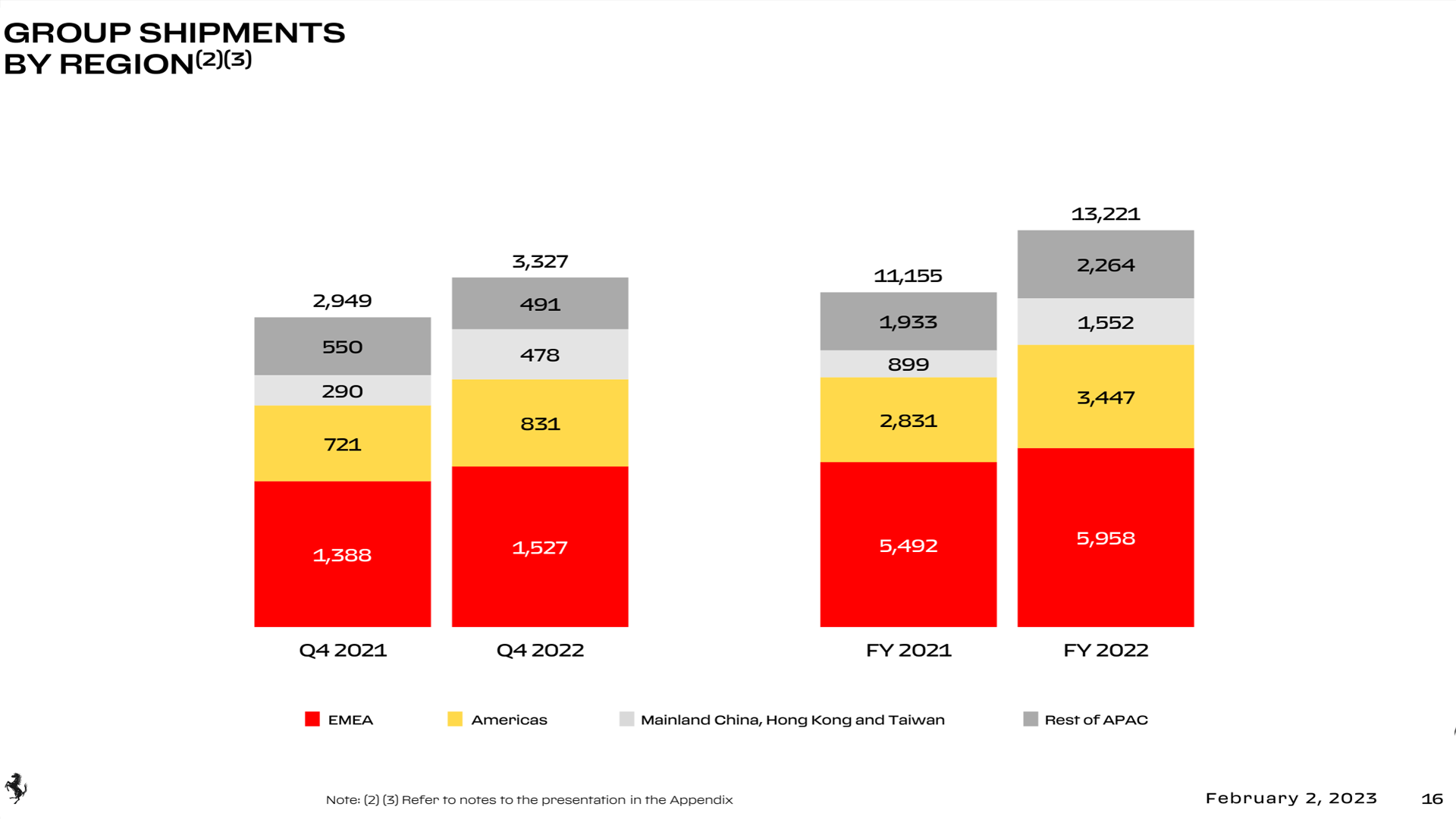

Ferrari has basically doubled its shipments in China while slipping in the rest of APAC.

U.S. Shipments stayed strong as well while Europe maintained modest growth.

There is a growing contingent in China that likes luxury brands and has the money to buy Ferrari cars and their exorbitant extras.

Some industries really benefit from the luxury model and it appears that automotive is one of the big areas where catering to a richer audience can still yield explosive growth.

Ferrari also posted an outlook that's projecting a 26% margin for 2023 -- which would simply be wild considering their big push into EVs as well.

Ferrari Outlook:

We honestly don't need to add much to our update on Ferrari.

Our only concern with Ferrari was declining yearly profit and the company managed to keep profits increasing by a factor of 13%.

That margin growth is simply wild, but it also gives us long-term confidence for Ferrari as well.

Remember, Ferrari has committed to transitioning to a largely EV-based fleet of models in the next few years.

The fact that Ferrari can keep this release schedule and stay ahead of inflation at this rate gives us confidence that, even if EVs become prohibitively expensive to make, Ferrari's customer base will simply pay whatever the cost to drive an EV with Ferrari branding.

This is really encouraging with rising materials costs.

Ferrari can afford to muscle out more mid-tier competitors for Lithium and other expensive metals since they have the confidence to pass those costs onto their consumers.

While Ferrari probably won't have any meteoric growth in the next 5 years, they're a solid semi-defensive play in a really dynamic auto industry.

We're really excited to see where they take this from here.

Rating: Overweight

Market Cap: $49B

Dividend Yield: N/A