Is Meta Stock Finally A Buy?

Mar 28, 2023Price Target: Unlock

Target Date: Unlock

Current Price: $199

Stock: Meta ($META)

It's funny how the market changes. We spent the better part of 2021 and 2022 making fun of/ completely avoiding Mark Zuckerberg's absolutely bonkers shift to the Metaverse (see it here).

But now, after a full year of the stock absolutely tanking, costs and revenues have finally balanced out in such a way that Meta looks more like a discounted value play than anything else.

Despite how iffy we still are about the shift to the Metaverse, the core business of Facebook and Instagram are still stone-cold cash machines that have not slowed down despite staff reductions. With more layoffs on the way, Meta is starting to look cheap compared to its rivals.

There are other really strong trends we like -- as well as a few potential moonshots that could make Meta even more valuable in the next 5 years.

To make it quick: Reels is actually becoming more and more competitive every week, and that's before a potential TikTok ban.

So let's take a quick look at how Meta is going lean and why now is a good time to jump on the bandwagon.

There's a lot to cover here, so let's get into it. 👇

Meta's Year of Efficiency:

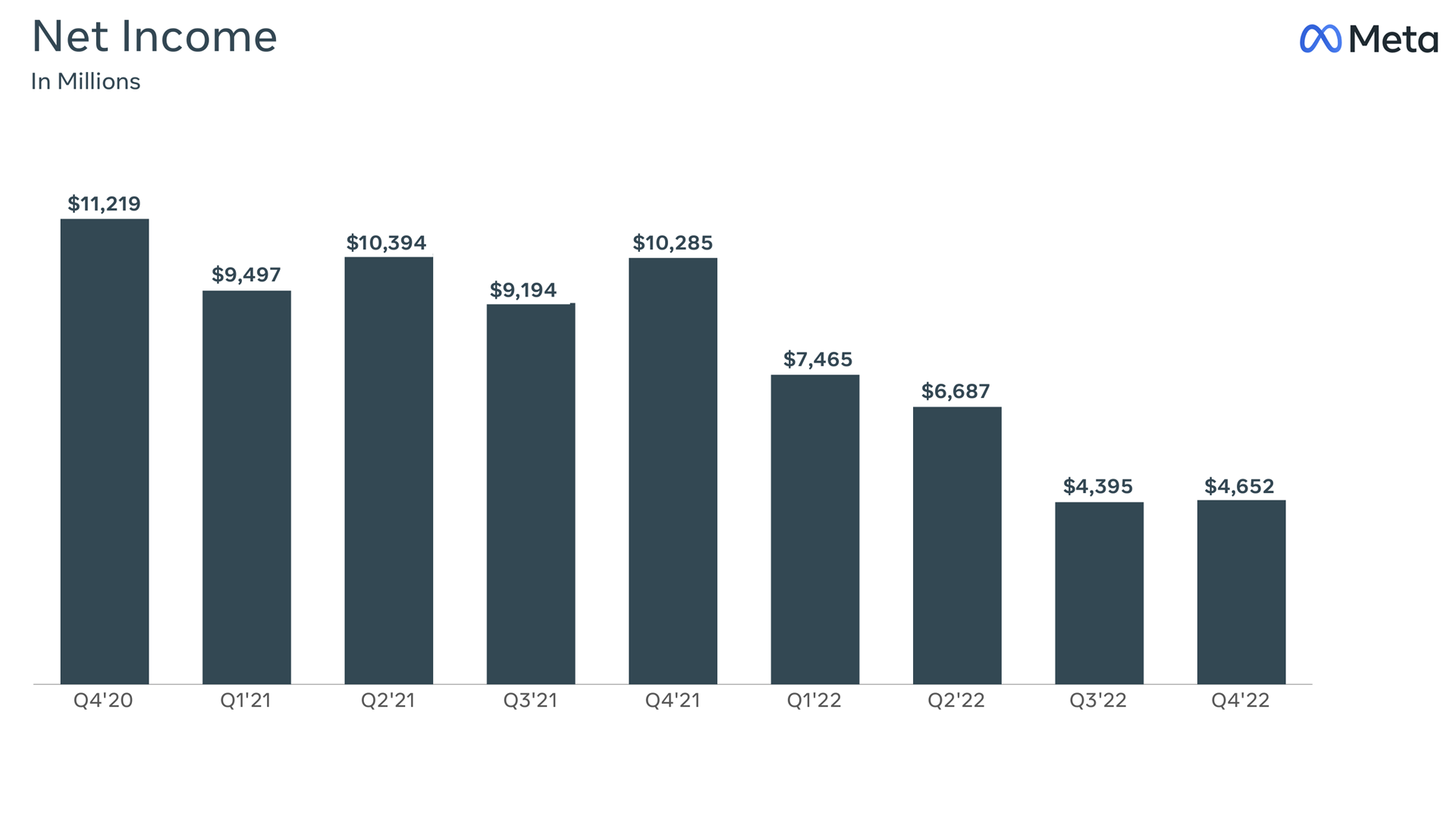

So what's been driving Meta's stock down? Is it really the market just thinking the Metaverse is a stupid idea? Even though it is, it's really due to this chart:

Meta made this big pivot to the metaverse in 2021 and started investing in itself at the height of the market. Looking at this chart, you can literally see the exact moment the market shifted under Meta's feet and net income got slashed by 30%.

With the metaverse not being an immediate revenue driver, net income has just fallen and fallen and fallen until last quarter -- when layoffs started to kick off a little and things started to improve.

We're gonna make like Zuck and not discuss the Metaverse too much in this article, because frankly, that's years away from being valuable.

What has been unfair to Meta is how insanely profitable its advertising business has been. Meta, at its core, continues to be a cash firehose that drives huge margins without a big need to expand.

So, the big news is Meta announcing even more layoffs throughout Q1 that will get its expenditures down to a level that matches this market. This probably pushes Mark Zuckerberg's metaverse ambitions out a few years -- but that's frankly a good thing.

These next layoffs get Meta back to where it needs to be. You can see the start of this process since the last round of layoffs came in the middle of Q4.

Combining these should be just enough to ensure Meta's margins match up with what the market has been expecting.

Furthermore, Mark Zuckerberg's comments about Meta gearing up to work like this for years is another encouraging sign.

What we saw in 2021 was the ability Big Tech has to hire like crazy at a wild pace.

Layoffs are harder, and Zuck is finally making the right move here to keep Meta lean for the next few years.

Should the market drastically improve as inflation cools (unlikely), then they can get right back to their future-proofing really quickly.

But it isn't just expenses getting under control that has us excited. There's way more brewing at Meta now.

Reels is Actually Growing:

Let's make this fast: Instagram users have managed to grow pretty wildly in the last 4 months.

After a year or so of monthly decline, the last 4 months have shown significant YoY growth according to the data firm Sensor Tower.

This peaked last month when Instagram hit 15% YoY growth, while its primary rival TikTok has actually declined 4%.

That's kind of an unfair comparison though, because Tiktok achieved such insane growth in 2021 and 2022 that them keeping it up would be almost impossible.

This 15% growth is way more impressive though because it shows that Meta is finding ways to stay competitive with the most powerful social media app in history.

Meanwhile, Instagram users are shifting more and more to Reels, Instagram's TikTok clone. Last year only 29% of Instagram users were on Reels consistently, while this year it's looking to hit closer to 35%.

Furthermore, Reels's revenue is set to nearly double this year on the back of some massive international expansions.

This might feel counterintuitive because most folks understand the narrative is more than just that Tiktok is dominating and Reels is lagging behind significantly. This may be true in the US (for now) but internationally TikTok is starting to struggle a little, while Instagram is gaining back a lot of ground.

Sure, we have all been shocked that Meta was unable to effectively steal Tiktok's product the way they did with Snapchat, but it's clear that Reels is slowly but surely catching on and boosting revenue for Meta.

But given the timing of this article, we want to be clear and say that our price target does not reflect a TikTok ban in the United States.

That would only grease the wheels from here. Even in the eventuality that Biden does not outright ban Tiktok, Reels is growing well enough to shore up revenues for Meta and keep things growing in the right direction.

Meta Outlook:

Efficiency and slow growth look great on the once-disruptor-king.

It's great to see a slower and more mature strategy from a company that just a year ago was poised to burn the whole thing down just for some goofy VR project.

While Meta studios and Oculus Publishing are growing really well, they definitely do not fit as the centerpiece for one of the most valuable products ever built.

Meanwhile, Meta is playing around in the AI space as well and has most of the tools it needs to be a big player as an AI disruptor.

At the very least, AI developments at Meta would help artificially push the stock higher.

Regardless, things are looking up at Meta and we're really excited to see where they push things from here.

Risk/Reward: Medium-High / Very High

Rating: Overweight

Dividend Yield: 0%

Market Cap: $525B