Can Monster Keep Outperforming The Market?

Feb 01, 2023Price Target: Unlock 🔒

Target Date: Unlock 🔒

Stock: Monster Beverage Corp ($MNST)

This opening to 2023 is all about answering a critical question: Which brands can bear the weight of inflation and which can't?

That's it. That's the only real question that matters in this macro environment.

Brands that post growth despite the economy shifting to "hard mode" will get overinvestment while companies that show the smallest sign of buckling under the weight of rising costs will be punished severely.

Some spaces are harder to predict than others, but sometimes the math is really easy. Like today, when we talk about one of our favorite beverage stocks: Monster Energy ($MNST).

The math is really simple on this one: costs rose for Monster, as they did for everyone else, and so Monster passed on those costs to US consumers to the tune of a 7% price increase in September of 2022.

And sales for Monster products did not decline significantly. That's it, that's the article.

Monster's brand has the staying power necessary to survive even this wild inflation situation when they are very much not an essential expense for consumers.

MNST will roll out another price increase in EMEA and roll out new locations across the next year that will keep their stock growing. That's all the info we need. We're done here, right?

Okay, maybe not. There are honestly a lot of cool details to cover and some interesting wrinkles to MNST's price increase rollout.

Let's dive through the details and see how this goofy energy drink company is going to keep the train moving 👇

Monster Overview:

Beverages are honestly a wild business and Monster has made major moves in the past five years to dominate the energy drink game.

Last we wrote them up, the environment was wildly different. But growth has still been at the forefront of their agenda.

Obviously, they are best known for their namesake, Monster Energy, but they have essentially spent the last decade cornering the whole energy drink market.

They own niche brands like Reign, NOS, and Full Throttle, as well as 'affordable' brands like Predator.

Whatever your feelings are on the energy category, Monster has locked in on a solid ecosystem of brand identities and leveraged them for just wild growth.

Monster is now in 143 countries with over a dozen affiliated brands -- which each have dozens of products and audiences they are designed to hit.

Sugar water with caffeine and other vitamins in it are simple enough that MNST can create enough niche brands to target essentially any audience. They have refined this branding and branching down to a perfect science.

But for all consumer brands, all of the branding in the world is irrelevant if you can't keep up with inflation.

So, the fact that Monster isn't getting pummeled on a 7% price increase when inflation (potentially) peaked at 9.1% back in June is the main reason to keep rolling with them.

Monster has brand spending under control, and for the most part, consumers aren't overreacting to the U.S. price increase -- which is giving us confidence about their upcoming EMEA price increase that will roll out over the course of Q1.

There is exactly one area of concern to keep an eye on over the next few quarters, and that's convenience:

Note: For how much MNST spends on branding and brand partnerships, it sure is wild they don't have even a couple of bucks left over for better-designed investor presentations.

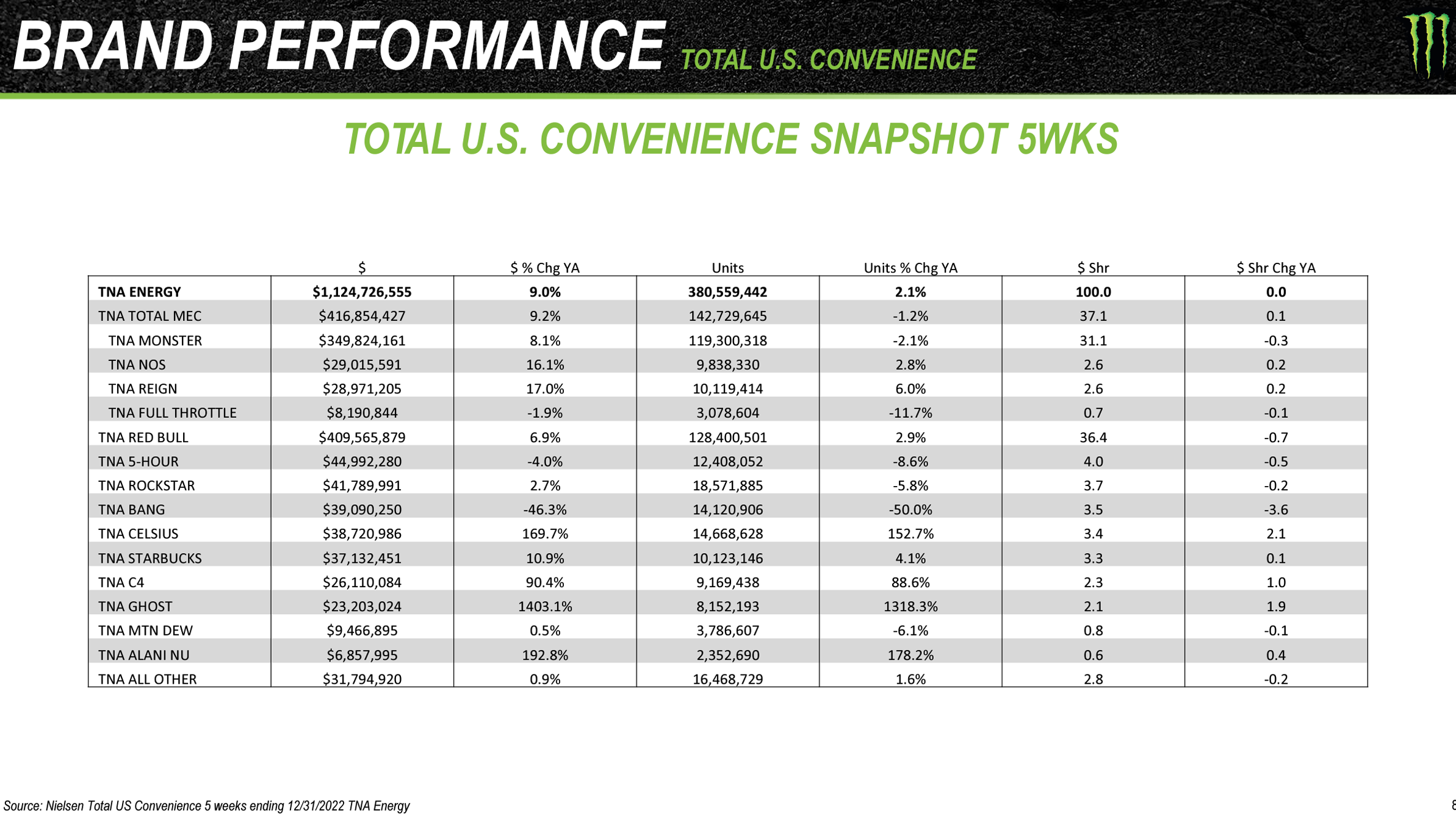

The key here is that over the last five weeks, total convenience sales grew revenue by 9%. That sounds rad until you compare it to the growth from the last 13 weeks when sales went up by 9.5%.

All this means is that over the course of the last 3 months, as Monster rolled out nationwide price increases, revenue growth from convenience stores slowed a little bit.

This makes sense as convenience store shoppers probably tend to be a little more price sensitive and some of those shoppers have decided the price hike was reason enough to cut Monster products from their budget.

Frankly, with how consumer spending has been in the last quarter, we expected a sharper decline here.

The major issue is that Convenience is the majority of MNST revenue -- coming in at over 55% of all measured channels in the last 13 weeks. If this revenue slip steepens as wage growth slows, it could turn into a problem here.

We won't start worrying until we see <8% growth though -- so there's a long way to fall before our bull thesis is in trouble.

And that's simple, while Monster is a huge business, margins for consumable products like this can be razor thin given the astounding amount of brand spend you have to do in order to maintain revenue growth.

So, what else can they do to bring more money in?

Massive Expansions:

This analysis is weirdly timed because in the next few days, you're probably going to start hearing about something called "The Beast Unleashed " in the wind-up to the NFL super bowl.

The Beast Unleashed is a massive step forward for Monster as it's their first foray into the alcoholic category.

Putting this article together raised a lot of audible groans from the Millenials on the Moby analyst team, as it brought back memories of the early 2010s and how alcoholic energy products like Four Loko completely took over our young, foolish lives.

The Beast Unleashed is hard Monster energy and is set to explode across the nascent non-beer alcohol vertical across the first half of this year.

Hard Monster makes a lot of sense and it fills a niche that hasn't really been explored in this seltzer-based canned alcohol renaissance.

We're also excited for Monster to launch their "affordable" energy product Predator in China, along with over 30 other countries (with a bigger push in Latin America).

No one brands like Monster, and no one nails these rollouts like the energy titan.

Monster Outlook:

And that's the whole ballgame really.

Monster has been pivotal in how it expands and which audience it expands into.

The fact that they have the confidence to expand into multiple markets in China and other APAC countries demonstrates their logistical and branding mastery.

They have capitalized on broader, cheaper branding opportunities like niche athletics and e-sports to ensure they keep growing their customer base without burning their costs to the ground.

We'll keep watching price-sensitive areas like convenience to ensure they don't fall behind, but for now, things are looking really solid for MNST.

Like we said at the beginning, inflation is really hard for companies but pretty easy for stock analysts.

Either you have a product that can handle higher costs, or you lose.

Monster has clearly demonstrated that they aren't a loser. We're really excited to see where they take things from here.

Rating: Overweight

Market Cap: $53 Billion

Dividend Yield: N/A

Risk/Reward: Medium / Medium-high