Northrop Grumman Corporation: Major in Military Defense

Sep 08, 2020Ticker: NOC

Rating: Overweight

Price Target: $485

Target Date: Post election – 6/30/2021

Northrop (NOC), a major name in the military defense space, has been winning contracts and platform that should continue to spur growth and earnings for years, if not decades, to come. Although we do realize the risk associated with a democratic win later this year and defense spending, we see the current valuation already discounting this in, leaving the juice well worth the squeeze!

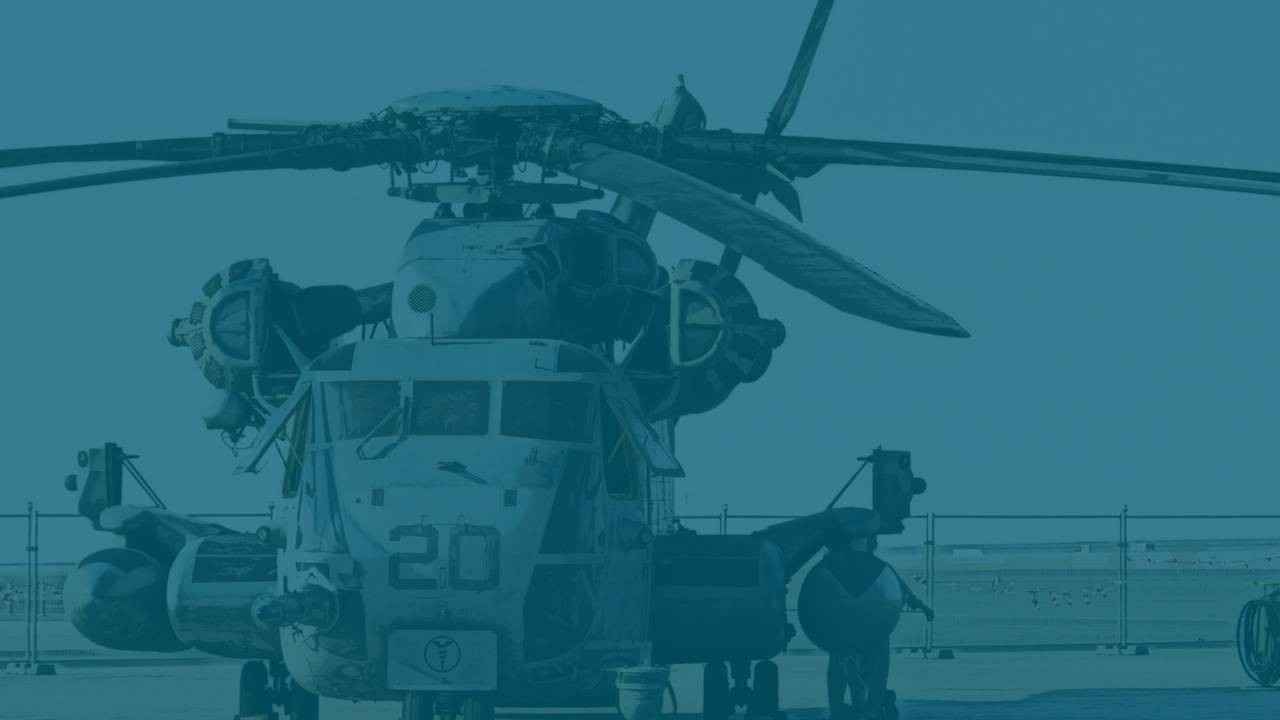

As we think through national spending priorities for 2021 and beyond, while closely analyzing the National Defense Strategy, we view the solutions offered by NOC to be one of, if not the strongest, in its class. Within this class of priorities we view NOC aligned properly to deliver on capabilities like autonomy, directed energy, and hypersonics. The company has the strongest portfolio to modernize the nuclear triad and has end to end solutions in space after its acquisition of Orbital ATK in 2018. These accumulated assets are extremely unique and these capabilities are already shown with their B-21 bomber and their intercontinental ballistic missiles.

While we view the company strongly able to deliver, we believe the market has undervalued NOC’s ability to do so. This is directly seen in their recent trading patterns. NOC is trading at roughly a 40% discount to the S&P 500 and inline vs. peers on P/E. With a notable discount relative to the market and room for improvement relative to its peers, we see upside potential for NOC’s multiple, especially if Trump is re-elected. This is so because at their current levels it appears investors believe a shift of power is coming towards the Democrats. And even if this is so, the current multiples are so inexpensive and have little downside if this event were to happen. So we believe the downside potential is minimal while upside potential, in their electoral scenario, should play out nicely in the long run (with an obvious tilt towards Trump getting re-elected). Given the macro environment and underlying financial models we’ve built, we’ve therefore assigned a price target of $485.