Palo Alto Networks Is Our Favorite Cybersecurity Stock

Feb 28, 2023Price Target: Unlock

Current Price: $188

Target Date: Unlock

Stock: Palo Alto Networks ($PANW)

The best part about investing in the right tech at the right time is that eventually, your capital gets access to flywheel effects.

That is, the entire thesis of SaaS investing revolves around profits achieving wild spurts of growth as old customers renew, new customers get added, and you continuously build your product suite so that your entire customer base can get upsold dozens of times.

Of course, in this current macro environment, that's a pretty difficult growth trajectory to achieve. Budgets are compressing and supply shocks are making it more and more difficult for companies to capture any kind of revenue.

Unless (of course) you're the kind of company that's becoming more and more necessary in the current climate.

That's the situation one of our oldest standby picks, Palo Alto Networks ($PANW), finds itself in.

After a year of flat(ish) up-and-down growth, our thesis has been proven out by industry spend consolidating around the cyber security giant.

PANW is establishing itself as the winner of shifting spend in the cloud space, and its security efforts are proving to be downright necessary in an environment more and more concerned about an ever-growing threat of cyber attacks.

This culminated last week when PANW broke containment and soared on the back of a trend-defying earnings call.

PANW has managed to get their revenue and margin expectations high enough that they're honestly in contention to enter the S&P 500. Even if more conservative trends continue, they're in a position to soar all through 2023.

But how on Earth have they kept this growth up? Let's get into it 👇

Building a Complete Solution:

There are a lot of factors at play when you try to understand why Palo Alto Networks is starting to break containment.

-

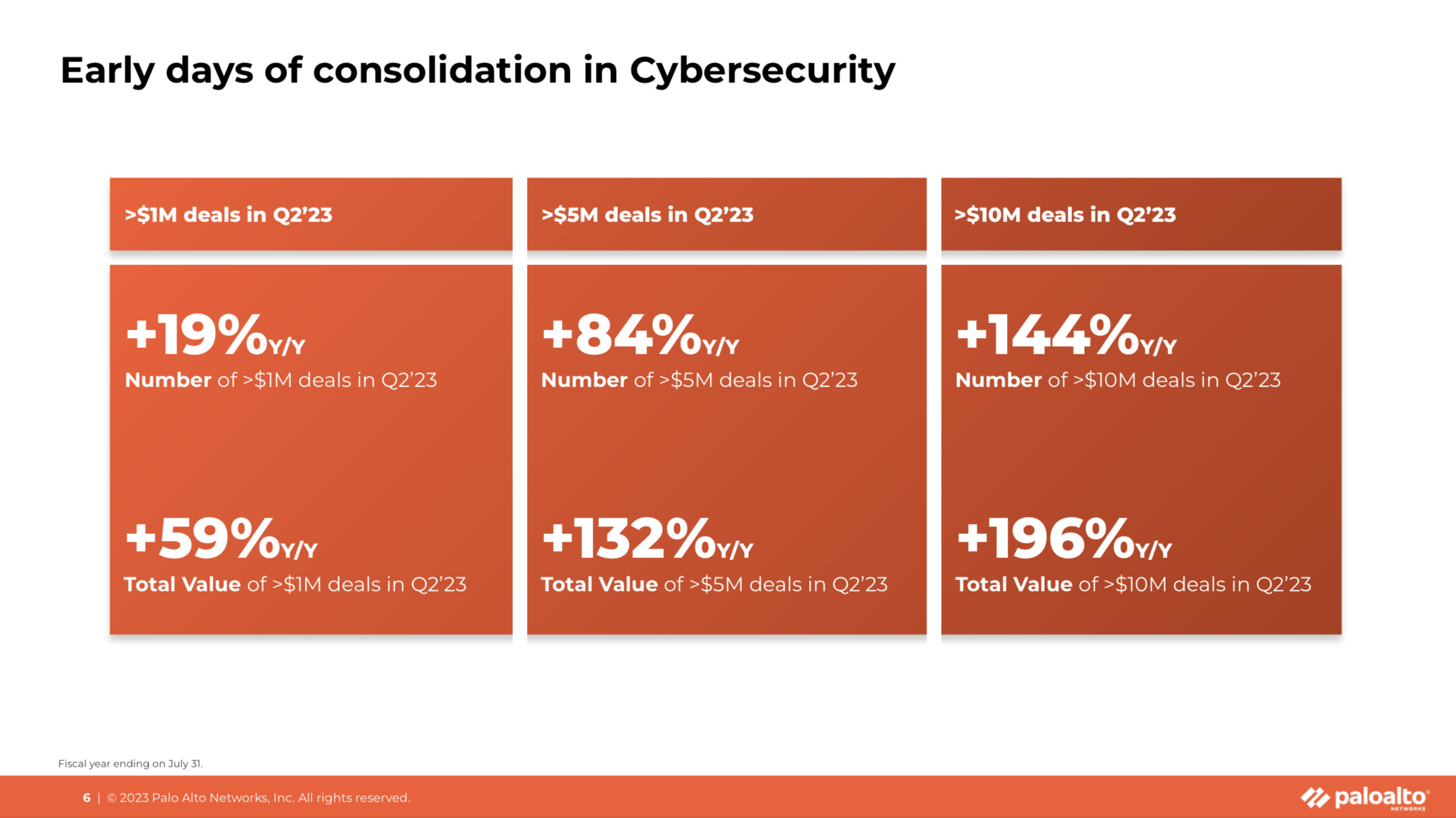

Big deals are growing off the charts. Palo Alto Networks grew revenue 27% YoY (year-over-year) on the back of some genuinely blockbuster deals. PANW is becoming the leader in enterprise deals. In our last update, we were very excited about the prospect of PANW growing their >$1 million deals by over 20% YoY. Those days are LONG gone as PANW was right to shift to more enterprise-level deals.

-

144% YoY growth for >$10m deals is ASTOUNDING, especially when we look at how much this was expanding last year. When we look at old-school enterprise cloud providers like Oracle, we're seeing spend absolutely flee those providers and head to PANW, Microsoft, and Amazon. Sure, Palo Alto Networks isn't getting as much share of the enterprise pie as MSFT is, but they're getting enough to boost a company of their size massively. The fact that PANW is valued at less than 5% of what MSFT is and they're in the same conversation as MSFT's most valuable product is completely wild. But more importantly, it's a solid value-catching opportunity for investors.

-

-

New products are creating feedback loops. Last update, we talked about how industry spend is shifting hard to security-first plays like PANW. All that spend is providing Palo Alto with two critical resources.

-

The first is (obviously) capital to fund new products and product teams.

-

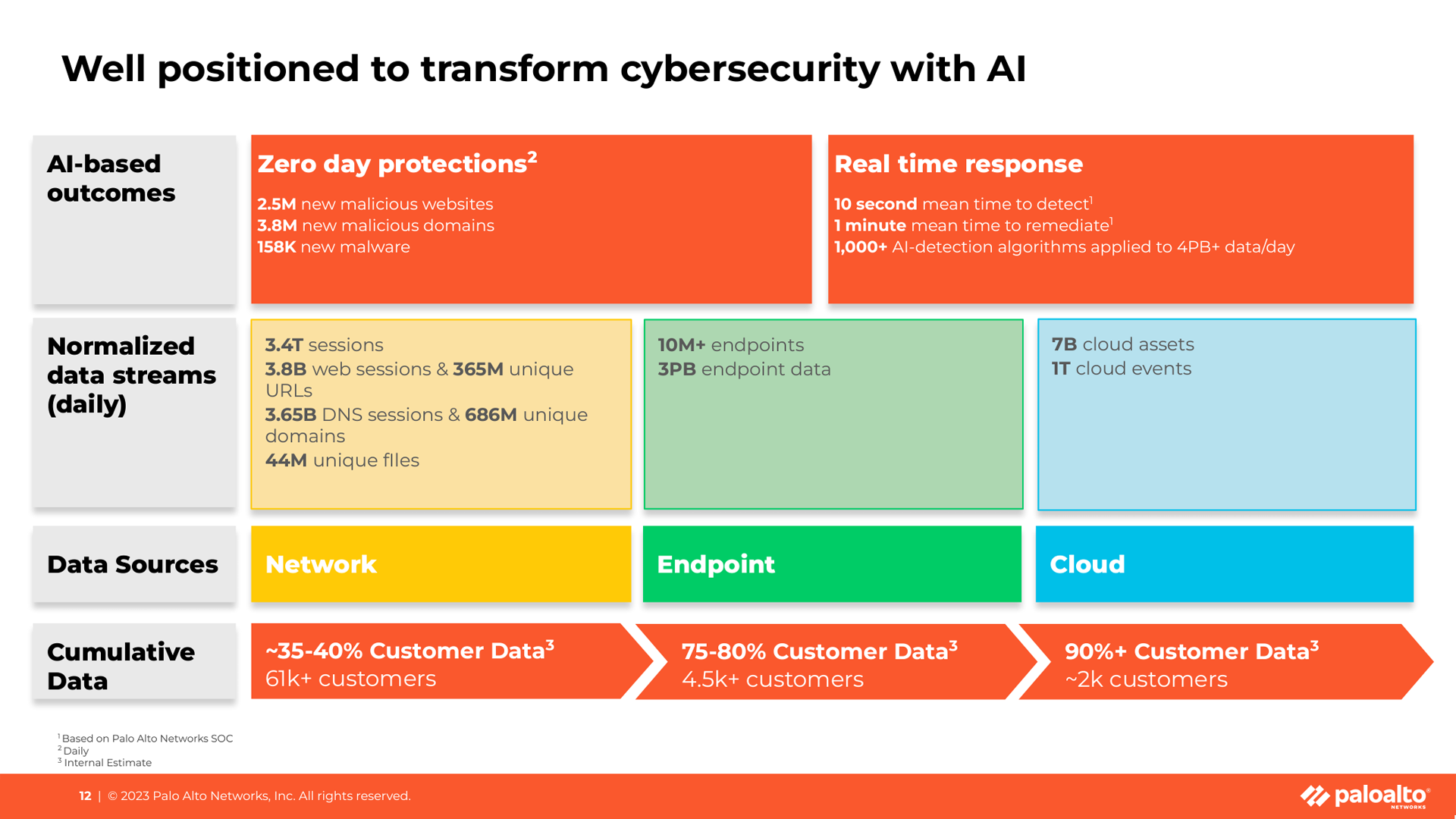

The second is way more critical: data to determine which products will be the most effective to build. Protecting and maintaining these massive enterprise ecosystems generates an astounding amount of data and all those little pieces of information can be leveraged to determine what areas need the most development. Anyone working in tech can tell you that most developers have hundreds of valuable ideas on what features will improve their company's product suite. Instead of tackling all those at once, the right data can tell product managers the order in which to build features on their product roadmap. PANW has clearly iterated in the right way here, as they have a bulletproof product roadmap and solid financials to back it up:

-

All of these new flywheels are great, but what can Palo Alto Networks do to keep accelerating growth from here to justify their slightly spicier valuation?

Where AI Is Actually an Asset:

With all the noise out there about how AI is about to upend all sorts of businesses, it's awesome to see PANW come up with actual use cases for the current state of artificial intelligence.

AI in its current form is more fast than useful.

Current models have a long way to go before ChatGPT and Google's Bard AI have strong product cases.

However, in the world of cybersecurity, there is a constant deluge of new threats and exploits that are constantly being discovered by bad actors.

One very expensive part of cybersecurity is discovering new threats before bad actors do. One way to cut costs here is to just throw an AI designed to exploit systems at your enterprise system and see how far it gets.

We're not going to lie, that's a pretty massive oversimplification of how AI can work for cybersecurity -- but it's good enough to describe how PANW has been brilliantly leveraging their data via AI to make their products constantly more and more secure:

Really take a look at that chart, the amount of data and insight and updates PANW is creating and iterating every single day is absolutely astounding.

This is going to be PANW's major differentiator as they keep achieving escape velocity with the amount of data they are generating with every single new customer they add.

Security in this new era is all about staying as far ahead as possible in an ever-evolving game of cat and mouse.

Bad actors are already utilizing AI systems to develop new attacks, but PANW is only going to accelerate how far they can stay ahead of hackers.

That level of security will continue to establish PANW as an unparalleled leader in cybersecurity--which will only add more customers to its pipeline as they continue to scale and iterate.

Things are only accelerating at Palo Alto Networks and they are achieving the SaaS dream of every new customer making their product even stronger for the next ones.

PANW Outlook:

We realize PANW is finally starting to get a little spicy with their valuation finally hitting 15x revenue. Of course, that valuation is downright cheap compared to comps of other cloud providers -- which gives us confidence that Palo Alto has way more room to run.

More importantly, PANW is finally at a valuation where they can potentially break into the S&P 500 later this year. An inclusion like that at their current valuation would give them massive tailwinds that will push them far higher in the next five years.

Meanwhile, their product simply is not slowing down. We love it when a tech company slots into the perfect niche at the perfect time.

It's true, the company is nothing but flywheels for the next year to come, -- regardless of the macro environment.

We can't wait to see how fast they start to push things as the year goes on.

Rating: Overweight

Risk/Reward: Medium/Medium

Dividend Yield: 0%

Market Cap: $56B