3 Reasons to Buy Plug Power

Nov 16, 2022Price Target: Go Premium To Unlock

Current Price: $17.50

Target Date: Go Premium To Unlock

Rating: Go Premium To Unlock

Well, the honeymoon period between green energy stocks and the wider market has definitely finished for alternative fuels like hydrogen.

Plug Power ($PLUG), our personal favorite green energy play, has fallen 40% since getting massively overbought during the mini bull-run euphoria surrounding the announcement of the Inflation Reduction Act.

This got compounded during Plug's earnings call earlier this month when they reported a revenue miss. This is pretty normal for a growth play like Plug, but it's especially bad because they were working with a smaller revenue target.

However, the company still maintained its guidance for the year, implying this revenue slump would be really short-lived. Furthermore, they shared some really exciting developments that only make us re-affirm our bull thesis.

There's a lot more detail to cover here, so let's just jump into the details 👇

Plug Power's Margin Woes:

If you're new to our long-term bull case for Plug Power, here's a quick refresh:

Plug Power is the current leader in green hydrogen production and utilization worldwide. They've built plants for making green hydrogen as well as fuel cell systems for companies to use said hydrogen. They're the kings of H2-powered forklifts and backup power systems that use hydrogen fuel cells.

Their stock got sent to the moon on news that Biden's Inflation Reduction Act would move their timeline for profitability way up to potentially 2024.

But now the stock is being hammered in unexpected ways.

Right now, it's key to realize that PLUG is still developing its green hydrogen plants. They are increasing capacity rapidly, but the vast majority of their revenue actually comes from grey hydrogen fuel cells that make hydrogen from natural gas.

And I don't know if you've been paying attention lately -- but natural gas prices have exploded in the last year thanks to this ongoing war in Ukraine.

So, instead of PLUG riding tax breaks off into the sunset, massive issues with supply chains have temporarily set the firm back. The IRA had the market expecting PLUG to immediately hit huge margins gains when they still need to bring all their green hydrogen plants to capacity to start getting those sick tax breaks. When you combine this with natural gas prices making their revenue-generation WAY more expensive, a lot of investors decided they jumped on the stock too early and bailed.

But what we like to see is that they are slowly but surely reducing the amount of hydrogen they make with natural gas while it gets insanely cheap to make straight-up green hydrogen.

Furthermore, natural gas prices should stabilize as more supply gets activated through 2023. That's why these revenue woes are looking more like a blip than a trend.

This is great, considering the actually awesome news that came out of PLUG's earnings call:

PLUG is about to hit Peak Cost:

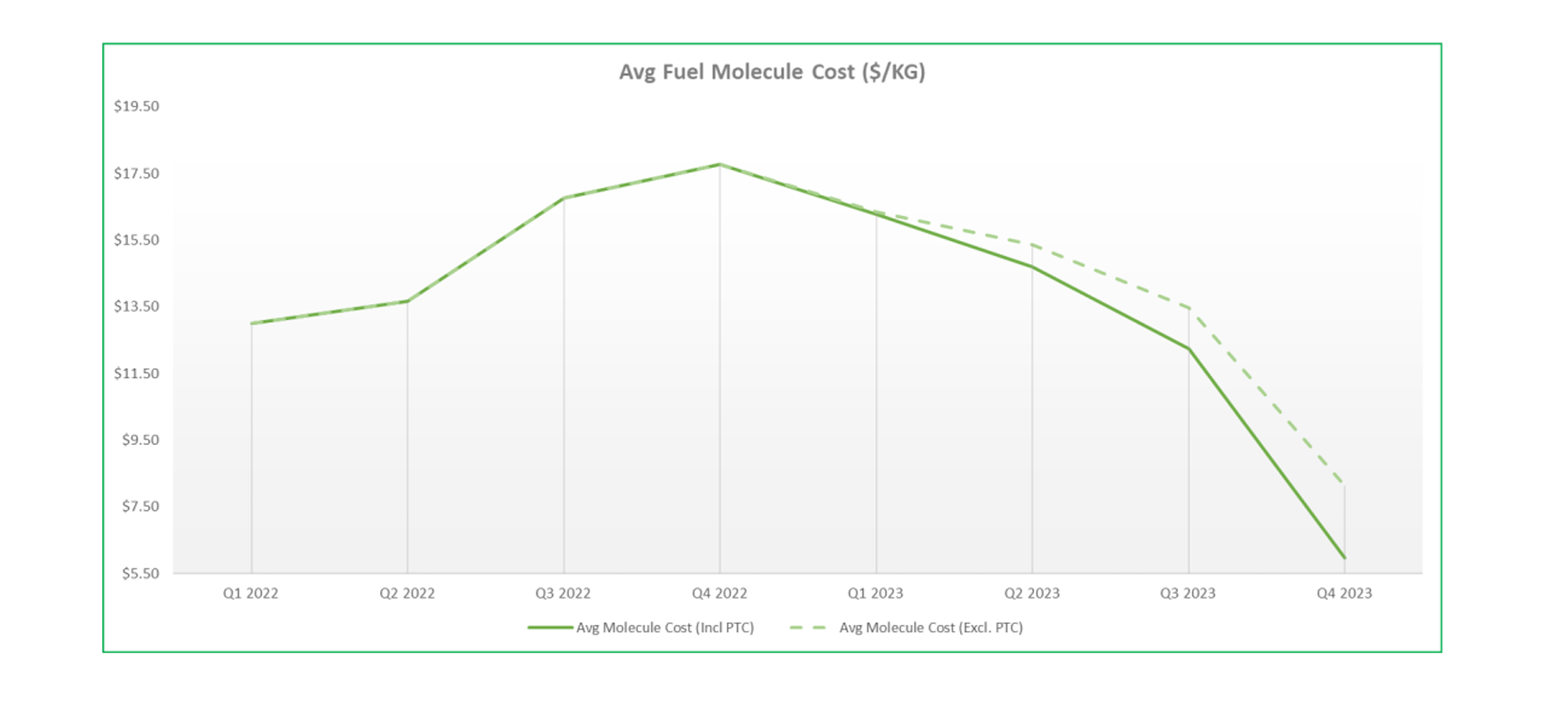

This may be one of our favorite charts of the year:

Basically, this is how expensive it is for Plug Power to make hydrogen fuel for all it's applications. It's an average cost--mixing the price of both natural gas hydrogen and green hydrogen. Even with natural gas prices expected to continue rising, Plug Power is projecting that the most expensive H2 will be to make is this quarter. After that, the party really starts for them as more green hydrogen plants reach full output.

As PLUG's backlog expands, they have to brute-force produce hydrogen any way they can. This gets pretty expensive as they work to establish and expand their massive green-hydrogen production capacity.

However, with their massive plant in Georgia set to come online along with many others worldwide, Q4 2022 is set to be their most expensive quarter for producing hydrogen of all time. Costs are set to fall sharply after that. If PLUG pulls this off, the government's $3 tax credit/ kilogram will kick in and accelerate the reduction of costs for PLUG.

All of this adds up to Plug Power achieving breakeven in their hydrogen production by the end of Q4 2023!

This is WAY faster than we anticipated, meaning that PLUG is being really shrewd in how they double-down on production. What accelerates this even further is the fact that PLUG can now take all the costs they were planning for maintaining their margins and use that to free up potential capital for more investment.

We love seeing PLUG get the opportunity for extra investment because they have such a primo dealmaking team at the core of their business development operations. They have been expanding internationally and within the United States. Their backlog is so massive that extra investment can get them 20%-30% more production capacity in the next 3 years but just throwing extra capital at building more production facilities. The PLUG vision is one of a worldwide network of green hydrogen production and servicing, and extra capital just accelerates their ability to hit those goals.

Plug Power is in a position where all of its flywheel effects are about to kick in and we couldn't be more excited! All they need is to hit that breakeven point and they can start using that revenue to optimize and expand their operations and turn into a massive money-printing operation.

Plug Power Outlook:

The hydrogen industry is about to become VERY competitive with subsidies as attractive as the ones just passed by congress. Even though they've had a small hiccup with natural gas prices--they're about to outperform with their plant development and new partnerships.

PLUG also just announced a huge deal with a grocer called LIDL which only pushes their immense backlog even further out.

We're keeping our short-term price target a little slow here to account for volatility, but this is a strong 5-10 year hold here for the analysts at Moby.co. We're really excited to see how PLUG performs with new competitors entering the space, and we're even more excited to see how far they can take this thing.

Risk/Reward: Medium-High/ High

Ticker: PLUG

Market Cap: $10.2B

Dividend Yield: 0%