1 Growth Stock to Buy Before the Next Bull Rally

Mar 03, 2023Price Target: $7.00 (66% upside)

Current Price: $4.20

Target Date: Q2 2024

Stock: Rocket Lab ($RKLB)

Sometimes you just have to double down at the right moment. And for us, that moment is here in Q1 for one of our top space stocks: Rocket Lab ($RKLB).

Yesterday RKLB posted a strong earnings call that came with a wider-than-expected loss that caused the market to sell out a little.

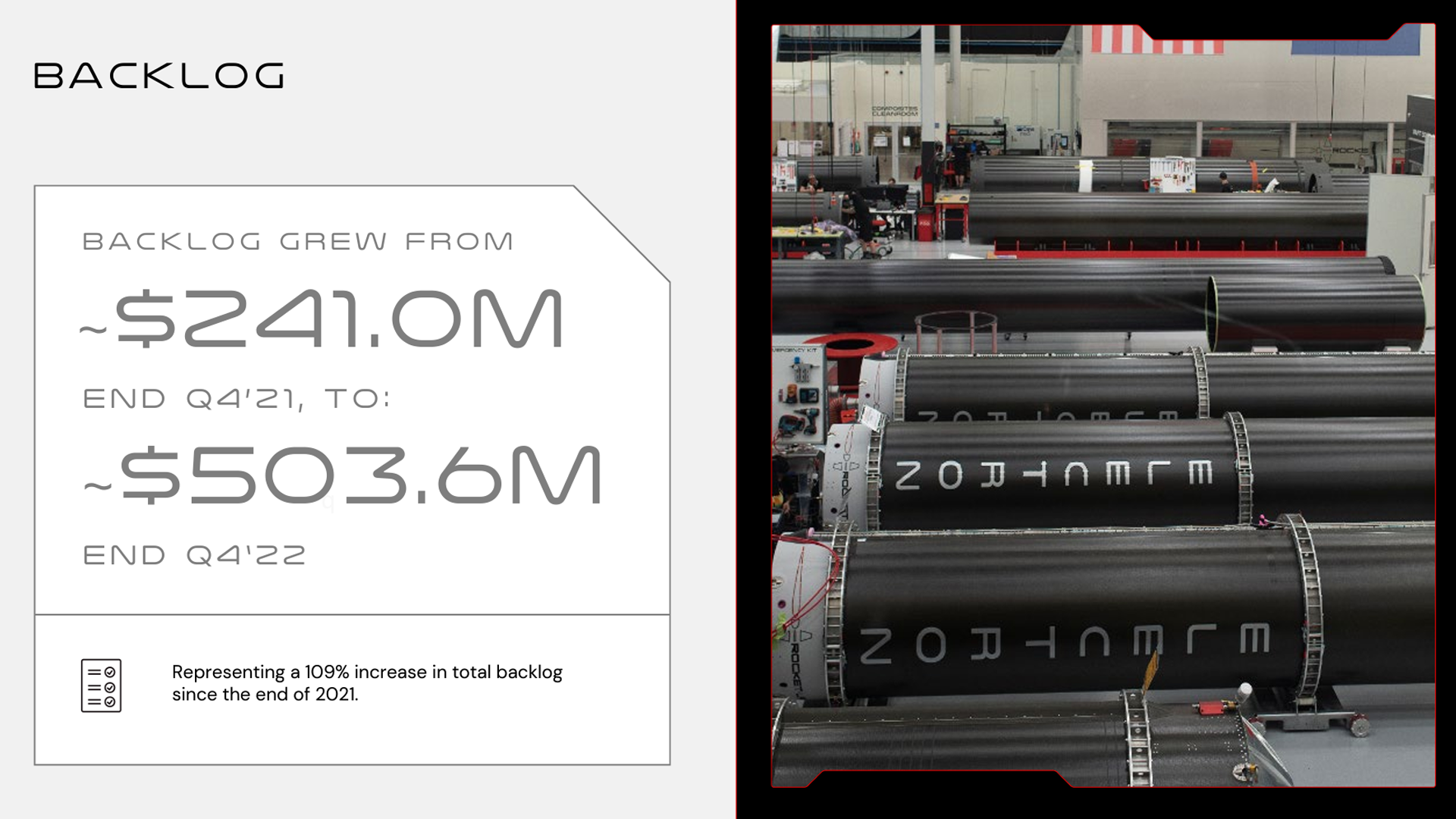

That hiccup honestly clouded the big news: RKLB has managed to double its contract backlog to over $500 million and is increasing its pace of launches.

While that came at a steep cost in 2022/2023, it could not look more brilliant as we're seeing some strong contracts and rearrangement as RKLB gears up to rule the small sat space

With a market feeling more cagey about big growth plays, we feel this is a solid moment to double down and boost our price target.

Let's go over the finer points here 👇

RKLB's Doubled Backlog:

2022 ended with a whimper for RKLB honestly. Weather pushed their first US launch out of contention and there really wasn't any great news to bring market sentiment back.

But 2023 is absolutely starting off with a bang.

First, RKLB got its opening US launch off without a hitch earlier in the quarter, and this month they will pull off two launches within days of each other from opposite sides of the planet.

Rocket Lab doing this so early in its development cycle will prove how independently these launch sites can operate and proves RKLB's scalability thesis.

Remember, you can only win the small satellite game if you can scale up the number of launches you can do. And March is going to be a huge month for RKLB if both of these launches go without a hitch.

And that's simply because Rocket Lab has doubled its backlog of contracts since the last time we were excited about it:

In a lot of ways, this is the whole ballgame for us.

To justify RKLB's really expensive development cycle, we need to have a lot of revenue on the books to keep the market from getting spooked.

RKLB's vertical integration with its space systems division is paying real dividends right now.

As a full-stack space as a service provider, RKLB just needs to keep building out its launch complexes and executing at the pace they have been before the stock starts getting access to strong flywheel effects.

Furthermore, RKLB is getting some solid news in the "getting paid" department as Apple is fronting 77% of the cost to manufacture Globalstar's satellite constellation.

RKLB is contracted to manufacture those constellations to the tune of $143 million and their payment basically got guaranteed upfront.

This de-risks a huge chunk of RKLB's backlog in their most consistent and profitable arm. We love to see it.

Electron is churning away and looking to accelerate in a big way next year, but what about Rocket Lab's big, expensive plans?

Neutron is Assembling:

You may remember that a huge amount of our bull thesis rests on Rocket Lab's next rocket: Neutron.

Well, Neutron looks to be a little ahead of schedule as RKLB has completed their first production facility and made huge progress on Neutron's launch pad in Virginia.

This gives RKLB access to US Defense spending as a solid revenue source for Neutron.

Furthermore, RKLB unveiled even more tanks for the Neutron rocket and gave positive comments about where they are in their testing phase for their Archemedies engine.

All is looking really solid on the Neutron front, but we will shit our analysis to be a little more bearish if we get to the 2023 investor day in September and there isn't a launch date planned for Neutron.

RKLB Outlook:

All-in-all, RKLB is looking like a really strong ecosystem moving into 2023, their revenue is in the right place and their expenses (while expanded) are there for the right reasons.

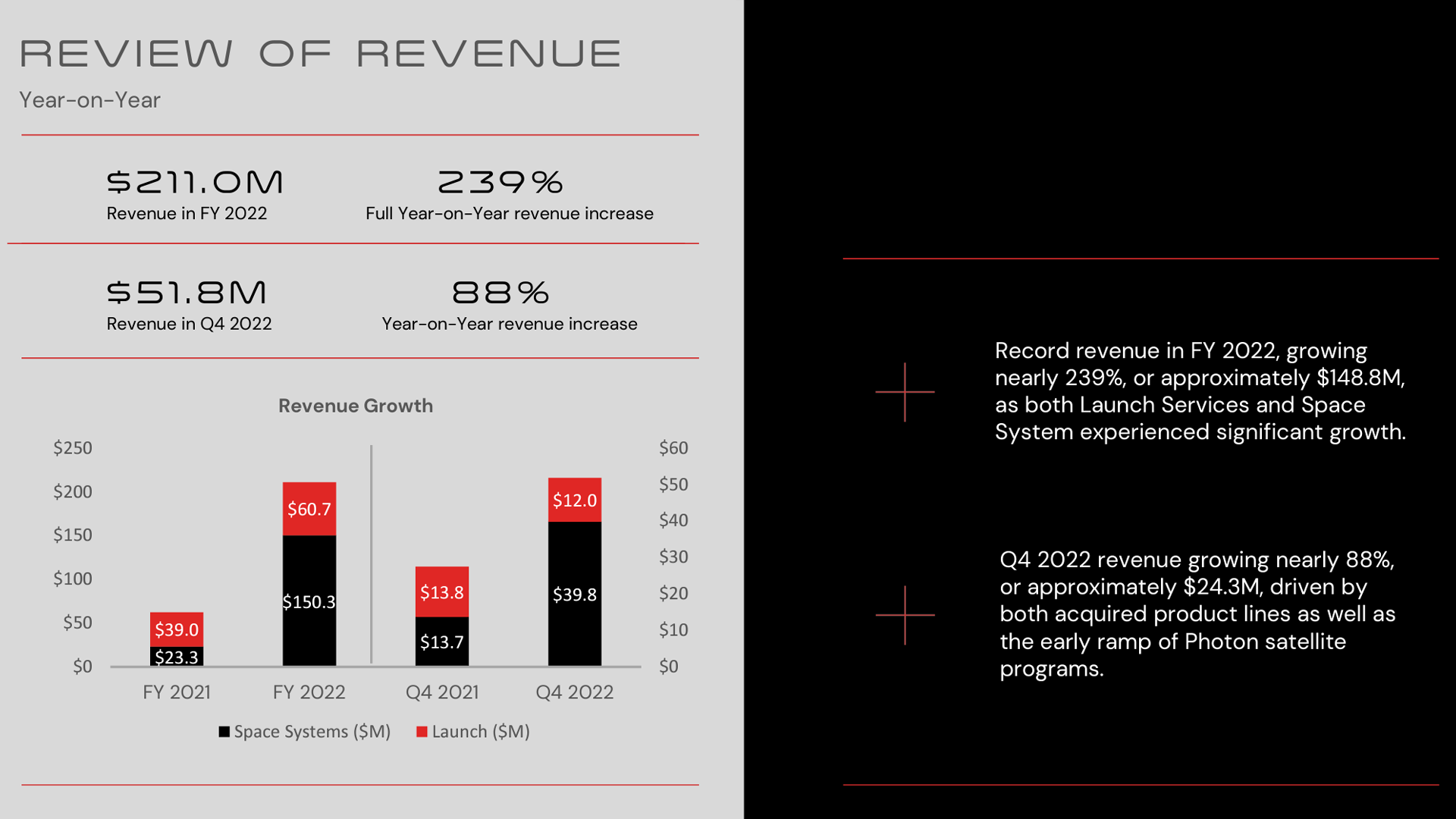

Revenue for the full-year 2022 basically tripled YoY.

The only issue is that their in-flows technically declined quarter-to-quarter and their costs ballooned.

Combine that with a macro environment that investors basically can't make heads or tails of, and you've got a stock that's significantly undervalued heading into a critical year.

We're watching RKLB's first true test of their scale with great interest, but there is one other factor that may make us bullish here.

Rocket Lab is the current leader in producing cheaper rockets and democratizing access to space, but RKLB's first truly dangerous competitor is going to hit a big milestone next week.

Another California launch company, Relativity Space, is doing the first test launch of its Terran 1 rocket. This would be a big competitor to Neutron a year before its projected test flight.

Why is Relativity a big deal? Well, Terran 1 is almost entirely 3D printed in this WILD factory in Southern California.

Rockets are expensive and dangerous largely because of how complicated they are to build.

3D printing has worked out great for Rocket Lab, but Terran-1 may be able to get costs and efficiency way more under control than RKLB ever could.

We're not worried in a big way right now, but Relativity could easily make the medium-launch space way more competitive over the next few years. We're watching next week's launch really closely.

But competition is always really great for shareholders.

Frankly, our biggest issue right now is that Relativity isn't on the public market and we can't make a speculative investment in them.

If Teran succeeds, that will help Rocket Lab develop the market further.

A huge chunk of Rocket Lab's backlog is basically guaranteed and all we have to do is sit back and watch them execute.

Risk/Reward: Very High/ Very High

Rating: Overweight

Market Cap: $2B

Dividend Yield: 0%