The Company Who's Dominating The Space Race

Sep 23, 2022We've been long on Rocket Lab ($RKLB) for a while now.

While the stock is down big this year (just like all tech stocks are), we've been using this time to gradually add to our position through this bear period.

And now a combination of a strong investor day and short-term interest unloading from the company has created a 2-5 year+ horizon buying opportunity.

We said it then (see it here) and we'll say it again -- we absolutely love this company.

But like so many stocks right now, our time horizon is in years instead of months. While it may hurt to see markets down, you'll be hurting even more, in a few years from now, for not getting so many of them at rock bottom prices.

But what we've seen from this company this year is an organization that is committed to winning the long-term space race from every angle.

They've made big bets on the small-to-medium space market and where it will be growing across the next decade. Unlike other space companies, RKLB is focusing on the going-full spectrum as both a launch services and satellite components provider. If you're thinking about space in any capacity, Rocket Lab has a service or subsidiary that can get you there and get you there at a truly wild level of cost-efficiency.

However, the market doesn't care about small details like that, it cares about big sexy attention-grabbing bets that can pan out now.

And so this week, the most important thing the market saw at Rocket Lab's investor day was not a lot of short-term updates about their industry-shifting Neutron Rocket. Sure, RKLB has secured a huge bag of government incentives to build and launch Neutron in America, but the Neutron timeline looks like we won't see any kind of big tests until 2024.

The way supply chains have been in the past year, that makes sense -- but this extended timeline was enough for RKLB to dump 18% on the back half of this week while the rest of the market went into full defense mode over continued concerns that the Fed is overdoing it's bid to beat inflation.

All we saw from RKLB was a company that is poised to be cash-flow positive by Q4 2023 and a business model about to be made unstoppable by the exact right kind of vertical integration. What we see today is a really strong buying opportunity.

Let's go over the finer points here 👇

Rocket Lab Update:

The name of the game right now is vertical integration. With their big period of M&A Activity behind them, how is RKLB digesting its new full-spectrum space-services business model?

Let's just say we really love what we're seeing right now.

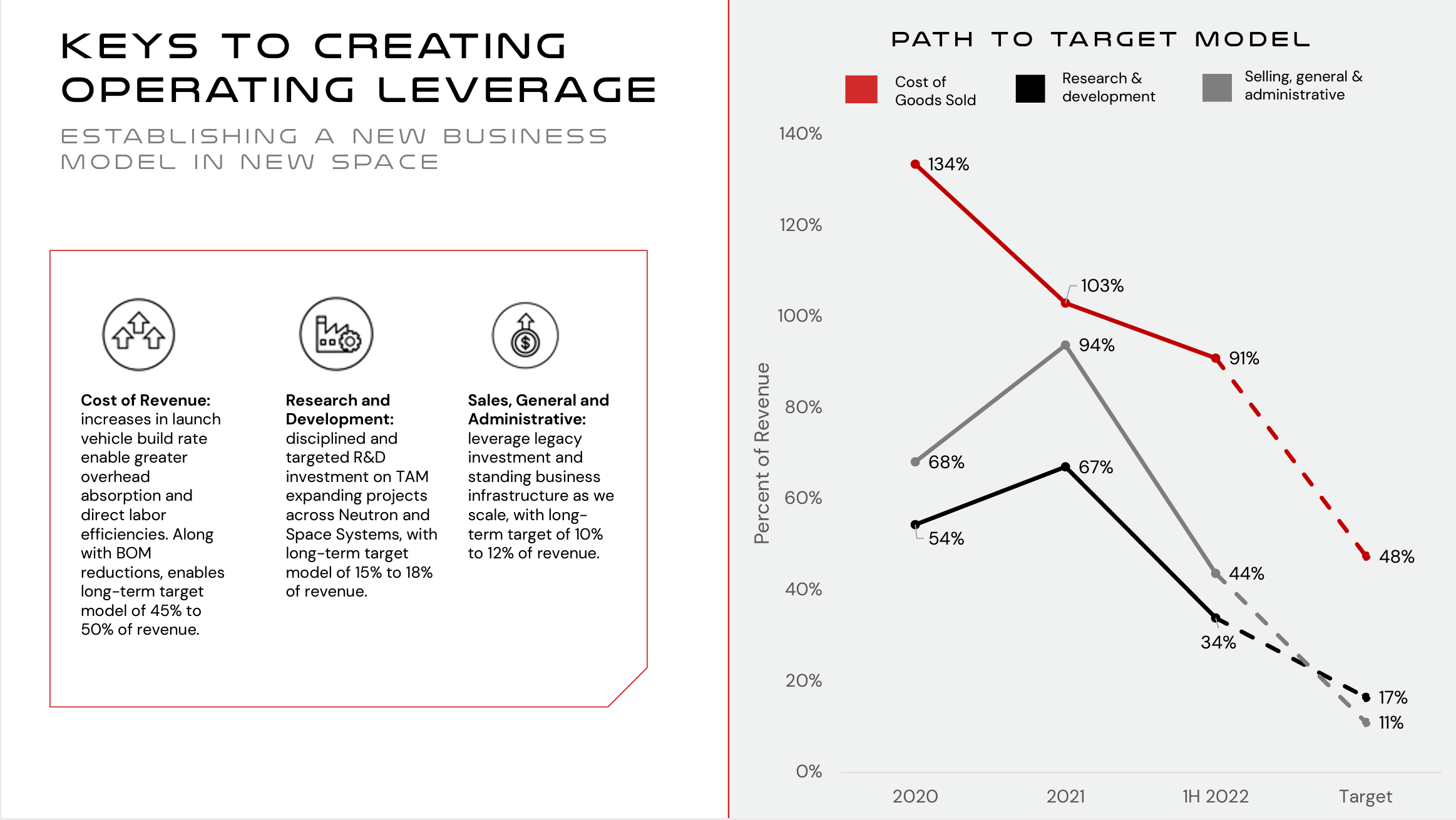

While production costs didn't sink as much as we wanted them to this year (which--is kind of a no-brainer with inflation and supply issues) RKLB has managed to cut other costs at a steeper rate to stem that burn.

The result is getting their costs into the black and massively reducing the cost of their goods sold by the end of 2023. Things are expensive since RKLB is still integrating all their acquisitions into their stack, but costs are on track enough to turn us into long-term bulls here.

A lot of that cost-cutting comes from RKLB doubling down on its sales pipeline and contracts with the US government that will take them from 12 to 24 launches a year.

Higher volume leads to efficiencies that result in a projected ~25% reduction in launch costs. But those margins are peanuts compared to vertical integration:

The satellite services providers RKLB is integrating into their systems have huge pipelines that lead to more sales, more bundled sales, and a much faster path to big margins.

Combine this with the half a billion dollars RKLB is sitting on in dry powder that can get them through to the next massive stage of their business, and we really have nothing else to say. Every arrow is pointing in the right direction--it just has a time horizon of 2-5 years.

RKLB Outlook:

Notice how this update didn't mention anything about their Neutron rocket (more on that here).

We honestly don't even care about that right now. Vertical Integration is going to carry RKLB for the next year while they build Neutron in a way that doesn't overleverage the company in the short term like other space SPACs.

The fact that Rocket Lab is teasing a human-rated second stage and capsule for Neutron is really just icing on the cake for our long-term price target but has nothing to do really with our short-term price target.

In the next year, RKLB will go through a bear market and/or recession like the rest of the economy and come out soaring by Q3-Q4 2023. We'll be averaging down through whatever bottom RKLB sees--because the mid-2020s could not be brighter for this company.

Satellites, space systems, and other small services will still carry them through the first half of 2023 -- so if you look at RKLB's price and feel a little nervous about buying a stock that cut 20% in a single week -- then bookmark this post and come back in Q3 of 2023 and check if RKLB has made any of the positive progress we've described.

Q2 2023 is a strong benchmark to make sure that going full-stack is the right move for RKLB and even if this recessionary environment deepens, there should be some positive motion in revenue and cost-cutting by then.

This is the cool part about being long-term investors. We like averaging down into RKLB despite the fact we initiated our first position right at the top of the last bull market (basically). 5 years from now, that timing will be irrelevant.

Rocket Lab is building a 30-year dynasty on the back of pitch-perfect vertical integration at a semi-decent time. We're really excited to get in on the ground floor here as the space market starts really opening up.

Long Term Price Target: 5x

Shorter Term Price Target: $6 (35% upside)

Current Price: $4.02

Long Term Target Date: Multi-Year Hold (think several years at the minimum)

Shorter Term Target Date: Q4 2023

Risk/Reward: Very High/ Very High

Rating: Overweight

Ticker: RKLB

Market Cap: $2B

Dividend Yield: 0%