The Company Bringing Back The American Dream

Aug 25, 2022Every week for the month of August, we’ve been bringing you long-term narratives we’re seeing emerge in the economy.

This is because this time of year is usually the sleepiest few weeks in the market before we start the big sprint to December.

Last week we discussed how government investment will help grease the wheels of the green energy industry and the week before that we talked about how increasing protectionism is going to be a strong tailwind for Lockheed Martin.

There’s another side to that coin though. As countries seek more self-reliance, a new trend is starting to take shape in America: Reshoring.

Reshoring is basically reverse globalization. After the global supply chain collapsed in March 2020, a lot of companies began the long work of bringing their manufacturing processes back to America.

This isn’t the most massive trend. Globalization and some form of our international supply chain are here to stay, but the amount of productivity returning to America is starting to become significant.

Reshoring is expensive though and through multi-year transformations like this, it’s usually more medium-sized businesses that benefit the most, as they can draft off of the huge capital expenditures made by the enterprises driving that transformation.

So the question is, "If the US keeps moving down this path to become more protectionist, what sorts of businesses will benefit the most?"

The pressures that drove globalization in the first place are still there: US labor is just more expensive than other countries. So, a secondary transformation is also accelerating: The increasing automation of complex industrial processes.

As we watch both of these trends accelerate—we see one winner potentially ready to soak up a TON of revenue from them.

Today, let’s introduce our position in Rockwell Automation ($ROK).

They're an industrial powerhouse that is simultaneously one of the most boring, yet one of the most important companies driving a wide range of innovation here in America.

The bear market isn’t entirely gone yet folks, boring is still beautiful in this market. Let’s take a quick look at the details below 👇

Rockwell Overview:

Rockwell is an industrial automation company that’s been around in some capacity since 1903 -- initially rising to prominence as the Compression Rheostat Company at the 1904 world’s fair in St. Louis.

Nowadays, Rockwell is a strong player in a rapidly crowding automation space.

We like Rockwell because their suite of products and brands allows them to service a really wide variety of verticals — from green energy to agriculture to food production.

After more than a century of designing and building better industrial equipment and processes across the US — Rockwell established a digital arm that allows them to help clients with digital transformations as well.

So now ROK designs and executes plans that help manufacturers and other industrial service providers automate and streamline their production using both analog and digital tools.

Basically, if you manufacture anything or have a complex service that is critical to the function and expansion of the US — Rockwell can find a way to make it cheaper and more productive. Period.

Rockwell Growth:

And that has paid dividends for Rockwell in the past few years.

Their revenue growth isn’t as sexy as some of the tech plays we got used to during the tech boom, but our analysts see the stock at a critical turning point:

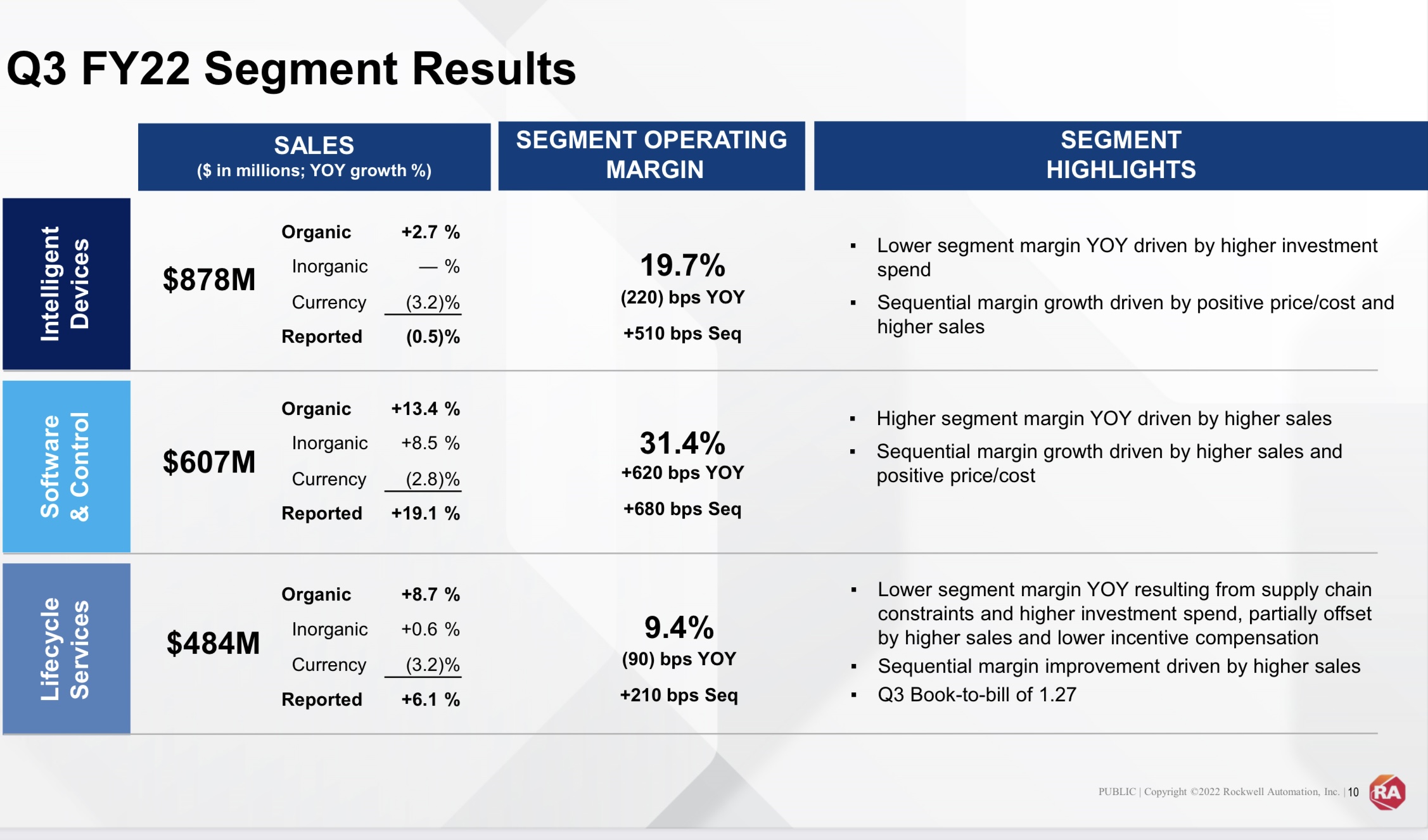

And it’s their software & control category starting to hit SAAS-level margins. 31.4% is a really solid number to see on the software side especially when the stock isn’t just a tech peddler.

This is a relatively unsaturated segment that Rockwell can keep taking over.

Furthermore, organic growth (that is—growth ROK doesn’t have to pay for) is growing stronger and stronger YoY.

This is going to give the team at Rockwell a lot of maneuvering room to develop their products more and execute more efficiently. Which is critical considering the inflection point where ROK finds itself:

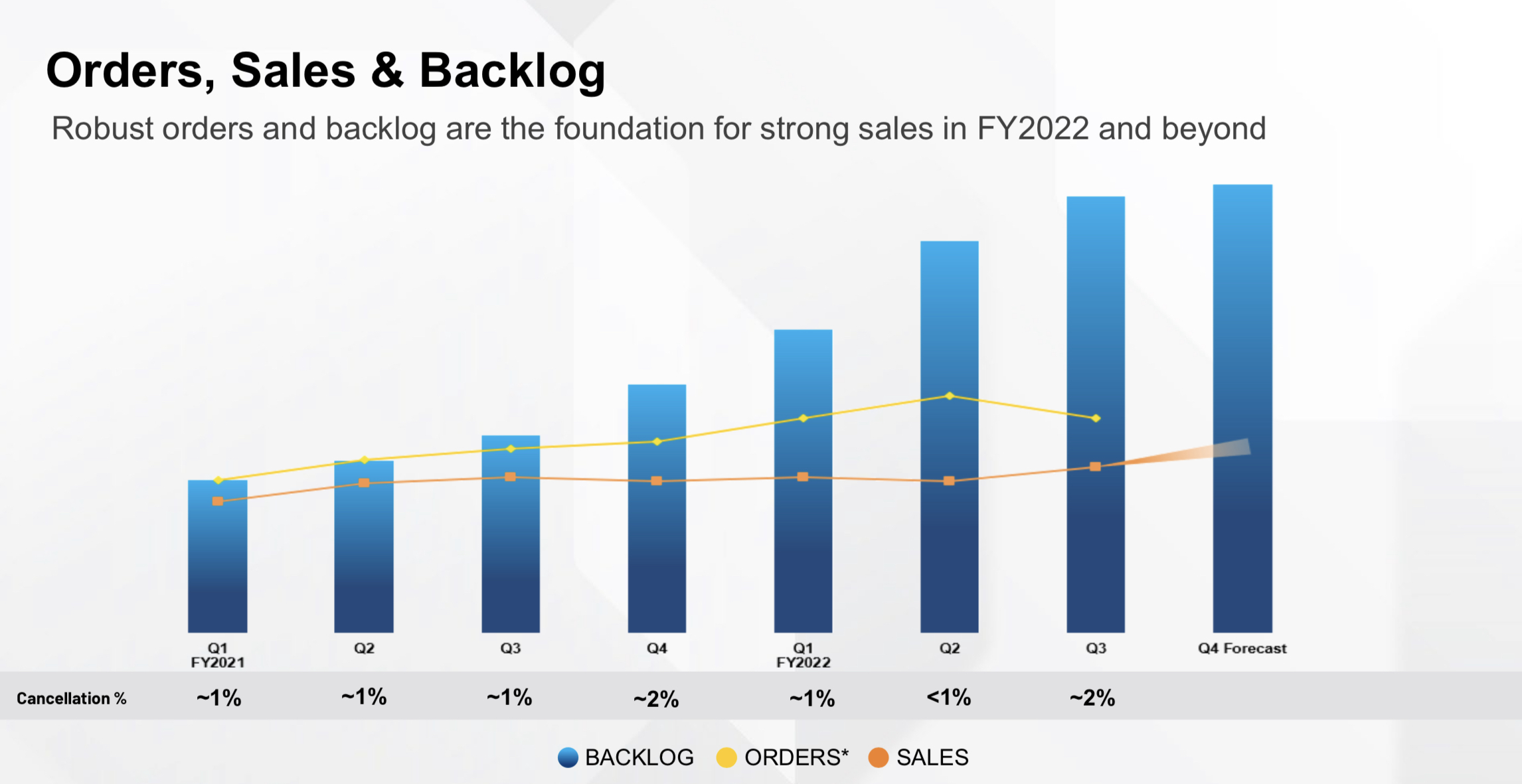

At first glance, this chart is awesome. ROK is so successful that their sales and backlog are accelerating in their growth.

At first glance, this chart is awesome. ROK is so successful that their sales and backlog are accelerating in their growth.

However, this quarter we can see that ROK’s backlog hit a critical mass.

Sales went up, but the number of executed orders went down a little while cancellations edged up from less than 1% to ~2%

This is such a small shift right now—but it’s something that can snowball for services companies like Rockwell.

Their services are complex and require skill and expertise and time to execute.

Rockwell is now in the midst of a critical sequence of quarters where they need to grow their business to match their demand better and get cancellations pushed down before they get out of control.

Which, if you’ve been an investor during the great NASDAQ bull run of the last decade—seems easy enough.

Tech companies can suck down insane amounts of capital on the hope of achieving a software multiple. Its a little harder to grow a company like ROK since we’re not dealing with just software here.

Of course—this cancellation number could also be cyclical. Q2 had companies dealing with some really powerful cost increases.

It’s just as easy to say this 2% number came from a bunch of prospective customers cutting costs and shifting to survival mode while they were getting choked out by energy and supply chain issues.

This is going to be a chief metric for us to watch while we nurture this position—but for now we’re still down with these growth numbers.

Rockwell Outlook:

Rockwell is in a strong position amongst a growing industry of service providers who are, in some capacity, bringing a small amount of industry back to America.

Protectionism and reshoring are potentially troubling trends in a post-nuclear world, but can also lead to solid business opportunities as we slowly assemble a new global paradigm.

As long as Rockwell continues to grow their software and life sciences verticals, we see solid, continuous upside for them moving forward.

Our price target isn’t as fun as some of our tech plays—but we also think it’s important to anchor our positions with slower, more predictable growth while this bear market keeps shaking out.

Price Target: $285 (18% upside)

Current Price: $242

Target Date: Q2 2023

Rating: Overweight

Risk/Reward: Medium/ Medium

Ticker: ROK

Market Cap: $28.07B

Dividend Yield: 1.84%