What's Going on With SoFi Stock?

Nov 03, 2022Price Target: $7.5 (46% upside)

Current Price: $5.12

Rating: Overweight

Target Date: Q4 2023

We've been reevaluating our thesis on SoFi ($SOFI) a lot lately, but this latest one is really exciting.

SoFi has been really brutalized in the last year as investors have fled high-potential tech stocks. The company has shed over 75% of its market cap in the last year as all these fears compounded.

But after almost exactly a year of this, we're excited to see some data that essentially proves our thesis on SoFi long-term.

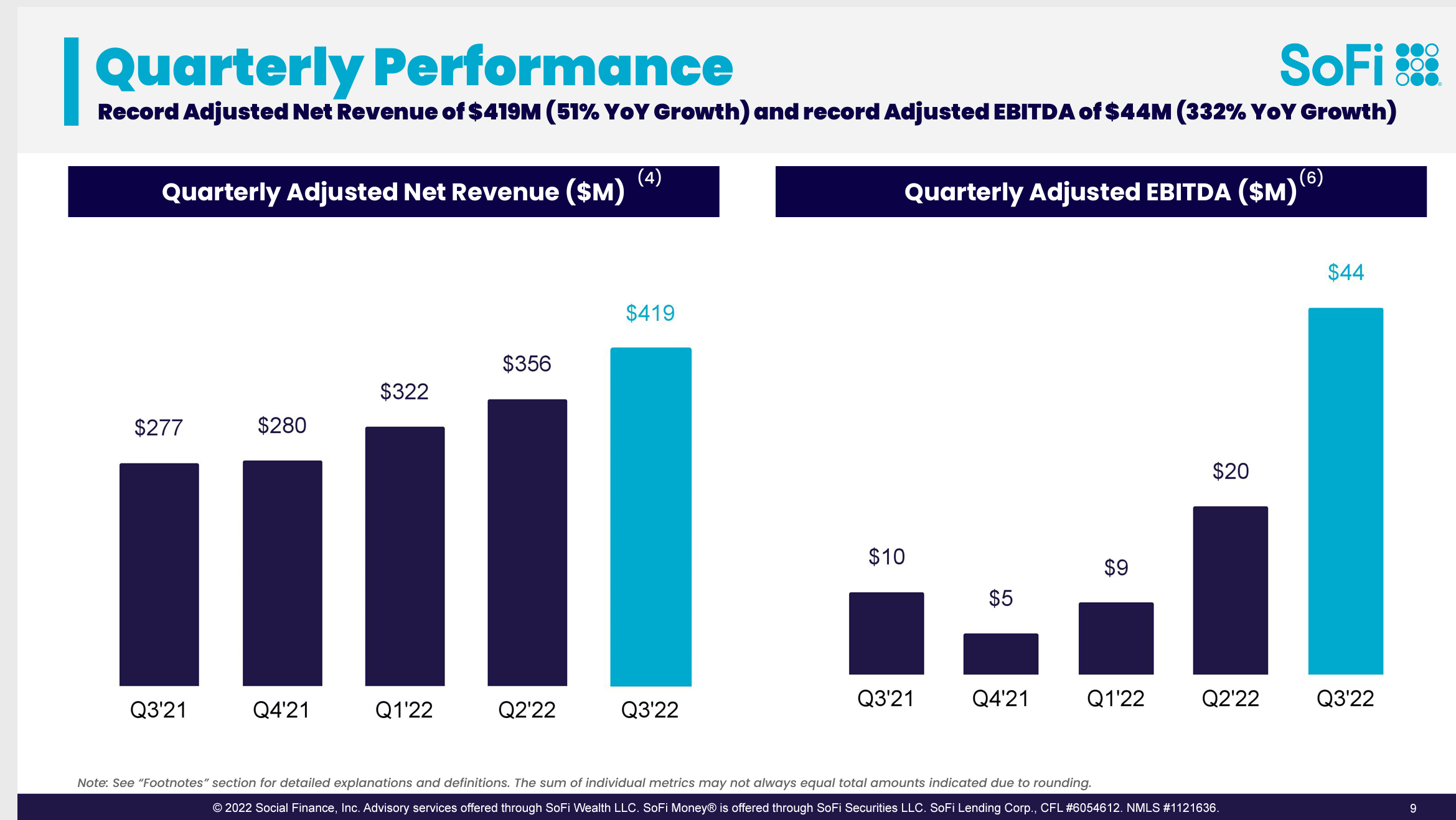

SoFi recently reported an earnings beat that's honestly hard to describe -- posting a quarterly EBITDA that grew 332% YoY. And that's in the middle of high inflation and after a year of getting pummeled.

The details leading up to that revenue beat are a strong proof of our initial SoFI thesis and so we're adjusting our most recent price target to reflect our far more bullish stance. SoFi has the infrastructure in place to be a FinTech juggernaut capable of assembling tech-company efficiencies that will drive profit for years to come.

Turns out you just might be able to solve Big Finance's issues with a strong dose of Big Tech. Let's get into the details 👇

SoFi’s Blockbuster EBITDA:

SoFi has been pretty volatile since reporting earnings--first up 8% on their revenue beat and then down 10% on general economic fears being driven by Wednesday's Fed press conference.

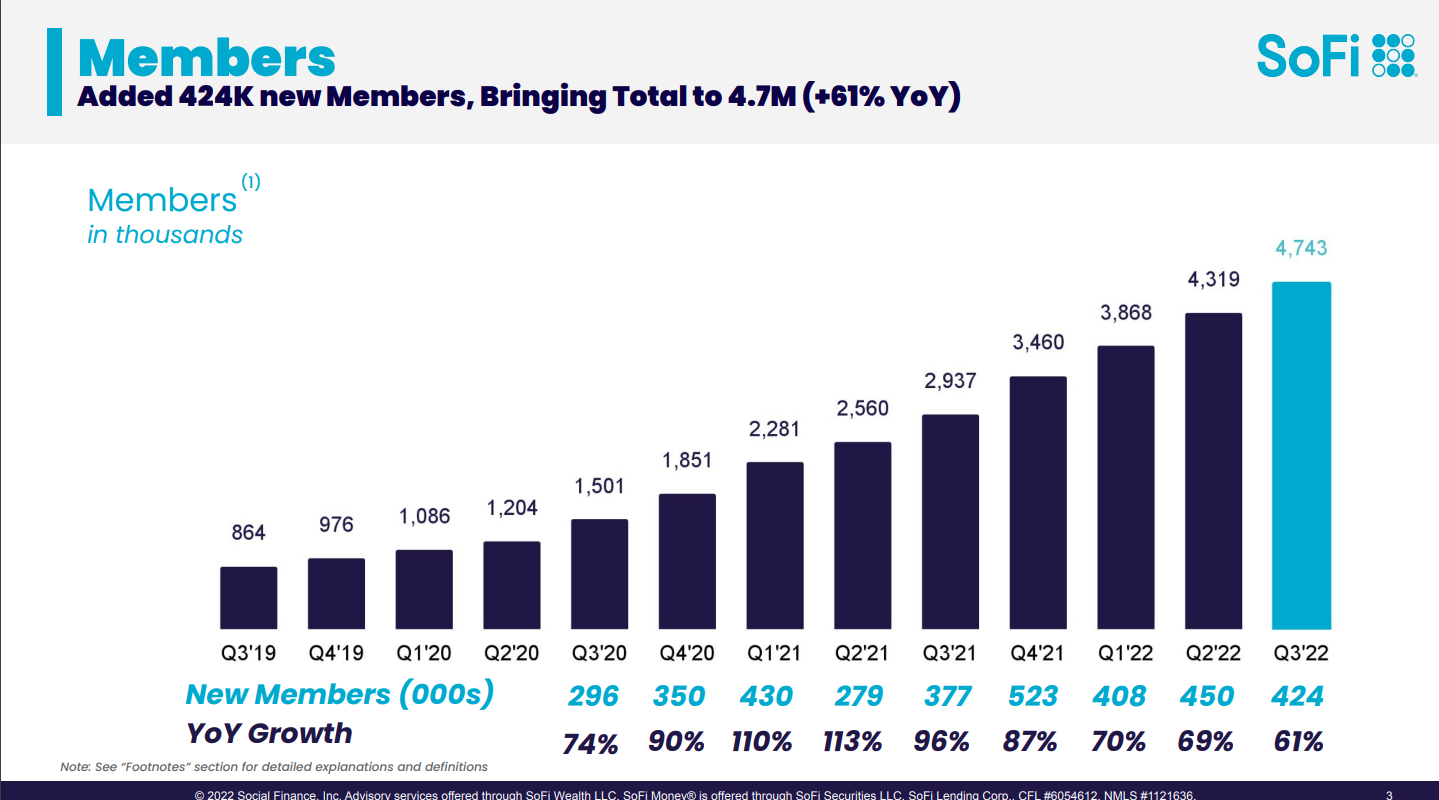

But we're ignoring the volatility and looking for the long-term narrative here. And when you look at SoFi's revenue growth, it really isn't anything special:

Sure, member and revenue growth is driving upward, but not at an accelerating pace that would make us overconfident about our SoFi thesis.

Instead, it's SoFi's absolutely ludicrous EBITDA numbers that have our jaws on the floor:

Yea, quarterly EBIDTA came in at $44 million, otherwise known as a 332% increase YoY and more than double what wall street was expecting.

Now, to get a little finance-guy on you for a second -- EBITDA is one way we measure profit. It isn't the way we measure profit, but it is an important way we track how much money a company is generating for each dollar spent. Technically, SoFi posted a loss for this quarter--and it was a bigger loss than last year's.

But this EBIDTA figure is insane because it shows that--yes--while SoFi is burning cash to grow their business, each individual dollar they're putting into the business is doing FAR more work than ever before.

In some ways, SoFi is cutting costs, in others -- big expensive bets SoFi made over the past 5 years are finally starting to pay off. No individual product is really driving the bus here -- a bunch of different business lines are coming together to make this magic happen.

The whole point of investing in SoFi was the hope that a digital-first model could bring SaaS efficiencies to a finance product. And that genuinely looks like it is happening.

SoFi's Standout Wins:

It's hard to pick the factors driving this growth, so here's our top handful:

-

A Bank Charter means WAY more interest revenue. SoFi finally had its (expensive) bank charter accepted, which allows SoFi to hold onto loans for a longer period before selling them. That gets them more interest revenue, and rising interest rates also make each new individual loan that much more profitable without adding a whole ton of extra work.

-

Gallileo was worth the money. Users of SoFi's massive fintech acquisition, Gallileo has grown consistently for 9 quarters -- unlocking a lot of user value for SoFi. The acquisition seemed overpriced at the time but is becoming core to SoFi's product ecosystem with users skyrocketing.

-

The Student Loan Moratorium Brings More Revenue. There's not much more to say about this. It looks like student loan forgiveness will stick despite some court pressure to knock it down. The moratorium finishing will take a huge weight off of SoFi's bottom line and drive growth moving forward.

For us, the big thing here is that there is no primary driver. SoFi is increasing revenue, cutting core costs, and growing in a way that the entire ecosystem is getting adopted by every new user. This holistic product is going to keep it sticky for users moving forward and give the team a LOT of options for increasing the value of each individual user as well as profitably adding more users.

Sofi Outlook:

With all this sell pressure clearing up, SoFi is set to benefit over the long run from higher interest rates and other factors that boost finance stocks during a period where the Fed is hawkish on inflation.

There still will be general sell pressure on the stock if this bear market deepens, as SoFi is still more in the territory of growth and tech stocks.

The fact that SoFi has kept revenue growing through this period is a testament to their initial thesis paying off though.

However, we are still keeping an eye on one potential major headwind. Loan Originations are starting to tick down for SoFi -- meaning that higher interest rates are pushing more and more people away from buying homes and starting businesses.

This is to be expected, but we want to keep an eye on it because SoFi is a new company and this may have an outsized effect on their balance sheet, offsetting higher interest revenue from folks who do take out loans.

But getting through the next year is critical for SoFi and we’re still really keen on maintaining our position as they build new pathways through this bear market.

It may seem like odd-timing, but we believe this will outperform on a risk-adjusted basis over the next leg of the economic cycle. And as rates look to peak, they'll start capitalizing from higher margins and increasing loan originations.

Risk/Reward: High/Very High

Market Cap: $4.7B

Dividend Yield: 0%