Why SolarEdge is the Best Investment in the Green Energy Boom

Dec 28, 2022Price Target: Go Premium To Unlock

Target Date: Go Premium To Unlock

Current Price: $278

Rating: Overweight

With the macro environment "starting to improve", we're looking forward to 2023 with a massive renewed investment in green energy.

Right now, our green energy portfolio is heavy with primary producers who stand to win big but could face unexpected headwinds and competition.

This is why it's really important to find suppliers who can win regardless in the green energy space.

That's because it takes a lot of work to build the infrastructure necessary to make our power grid more reliant on solar. So, why not instead take gains from folks who sell parts to the big companies taking on all that risk?

So today, let's talk about our new green energy portfolio hedge: SolarEdge ($SEDG) a manufacturer of Solar Inverters -- i.e. the magic boxes that turn solar power into energy folks can actually use to power their homes.

SolarEdge has been on a tear the last year gobbling up market share and broadening its serviceable market. Their TAM is massive and set to expand further as they lock in partnership after partnership with folks looking to make the move to solar energy.

There's a lot more to cover here, so let's just get into it 👇

SolarEdge Overview:

So, solar power is neat and all but it's useless if you can't actually plug things into it.

A solar inverter is a really important piece of the whole solar power ecosystem. And SolarEdge is one of the leading and most cutting-edge manufacturers of these inverters.

Making solar panels is really hard and expensive, but inverters don't require quite as much rare/ expensive materials to produce.

That's what makes SolarEdge attractive in a nutshell.

You get all the upside from continued investment in the solar space, without all the potentially wild margin impacts coming from every growth industry on Earth trying to suck up as much lithium, cobalt, and nickel as possible.

By zeroing in on infrastructure to make solar panels plug into the electric grid and work more effectively, SEDG can be the best in the business and focus on tackling a broad set of applications.

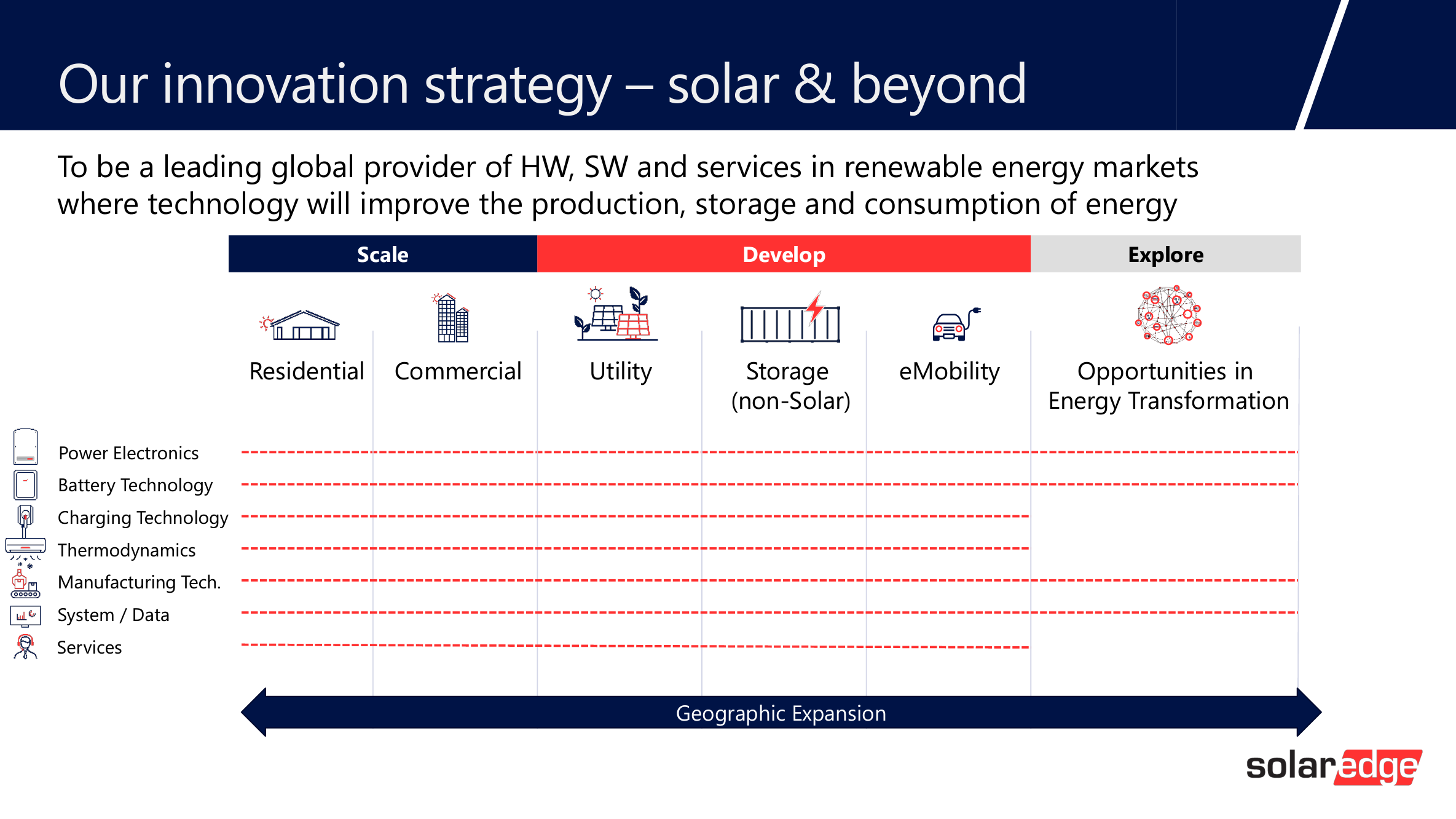

SEDG is rapidly expanding its residential and commercial applications and has been developing strong enough margins to explore energy storage as well as niche applications for solar infrastructure.

SolarEdge Growth:

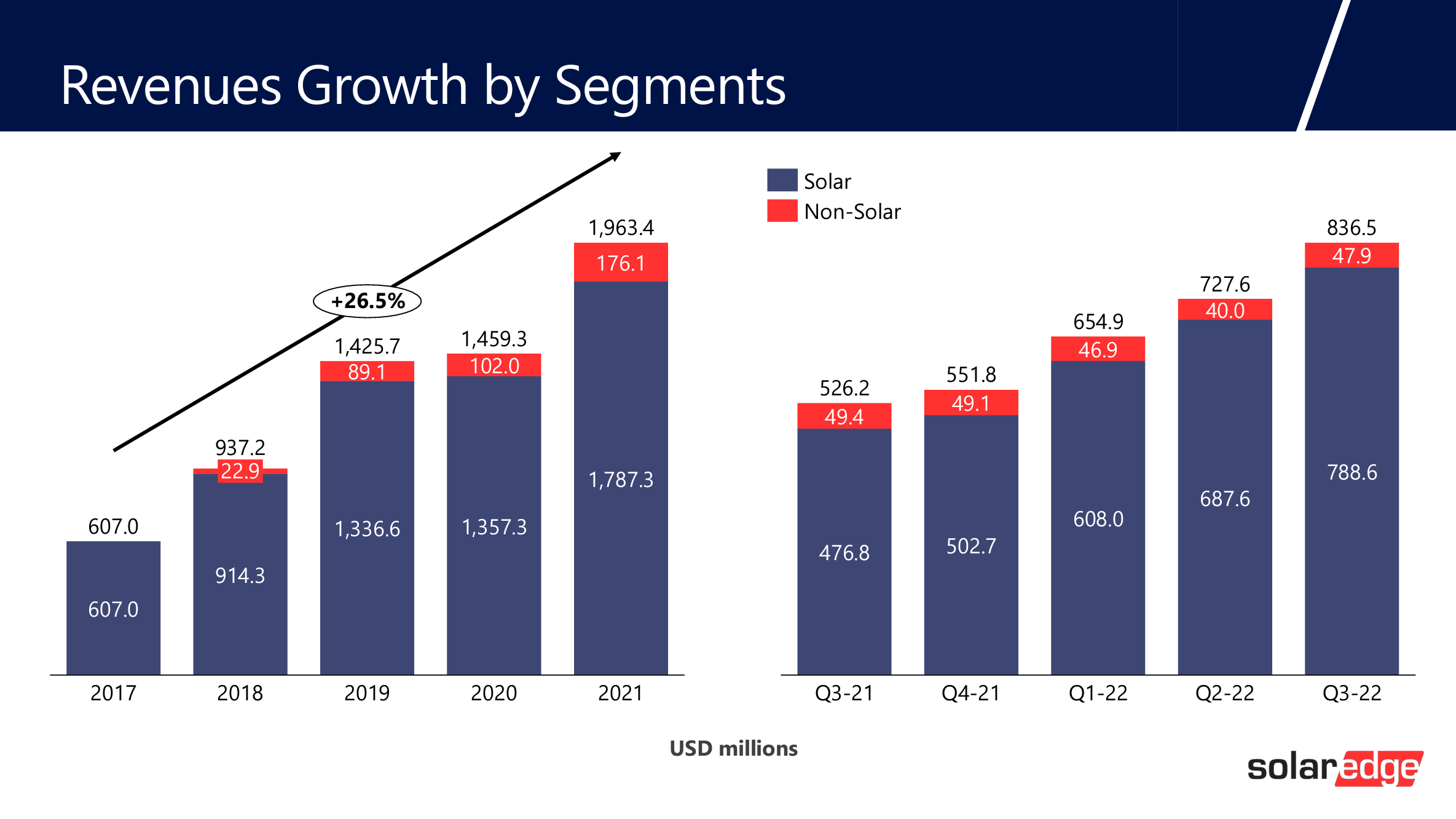

The main reason we see this as a strong buying opportunity for SEDG is their revenue finally getting back on track:

SolarEdge got hammered by 2022 the way the rest of the economy did, and it looks like their revenue and margins are finally back on track.

Q3 was the first positive margin movement the team at SEDG produced in over a year.

Even though they had fewer expenses than solar panel companies -- costs were threatening to get out of control for SolarEdge.

The exciting thing about these new margins is that SEDG can finally start investing more in those niche electric plays that will give them access to new industries.

SEDG is rapidly developing new systems that will get them deeper into the EV space as well -- which is gigantic as investments and subsidies keep flooding that part of the market.

In short, SolarEdge is the right company getting the right costs under control at the right time.

SolarEdge Outlook:

2023 is going to be a massive year for green energy regardless of how inflation and the macro environment shake out.

If costs remain high, SolarEdge is a solid defensive pick to help your portfolio whether the extended downturn.

If inflation gets under control and the FX situation calms costs down, then SolarEdge is poised for a mild breakout regardless of which players win big in solar.

Remember, one of the most important principles of any gold rush is ensuring that you invest in the folks selling shovels rather than just the gold miners.

We're really excited to see how SolarEdge can keep cornering its segment of the Green Energy industry.

Risk/Reward: High/ High

Ticker: SEDG

Market Cap: $15.5B

Dividend Yield: 0%