The Best 3D Printing Stocks

Apr 11, 2021Roughly a month ago (March 11th) we published research on Desktop Metal (DM) who operate in the 3D printing space. Since then the 3D printing stock has dropped from $18 to $12.50. While the price has dropped, our confidence in their long term operations have not. While there are several reasons the stock has dropped since our post, the gist of it is that there has been both a sell-off in high growth names due to inflation as well as general uncertainty about their underlying short term economics. Long story short however, we believe they will continue to grow and justify their valuation and then some! This is why we put a long term time horizon as we believe we need to mitigate the short term volatility associated with this type of 3D technology stock! It is only in the long term, can the growth story prove to be true as DM looks to revolutionize the industry.

With that context about DM, we also wanted to provide other 3D printing stocks that we like as well as context for our users who did not see our write up regarding DM. Please skip this section and go to the stocks, if you've already seen our 3D printing overview.

3D printing:

3D Printing is an innovative technology that lets you create a physical object from a digital model. All you need to do is make a design, transfer the file to a 3D printer, then bring your object to life. Once printed, the 3D printer produces layers of material, one on top of the other. This forms the finished object. So for example instead of manufacturing traditional hardware, 3D printers can recreate the same finished products by designing it on a computer and just clicking print! Think of it similar to a traditional printer but instead of 2 dimensional it is 3 and can use other materials (not just ink - it can use metal, graphite, etc.)!

So why is this so revolutionary? 3D printing is so revolutionary for a few reasons:

- Speed: Companies can now build prototypes and innovate faster than ever. Rather than using traditional means of manufacturing, by investing in 3D printing, companies are able test their ideas in real time and make changes faster than ever. By doing this, companies can rapidly increase the speed at which they bring new ideas to market and quickly validate/invalidate ideas.

- Cost: Compared with traditional means of manufacturing, the cost of printing objects is significantly cheaper and more efficient. Layer in the saved labor costs and the cost of innovating and scaling products can now be cheaper than ever!

- Quality: During the manufacturing process, error can easily be introduced that gets amplified and can lead to catastrophic consequences. With 3D printing, you remove all of the manor labor and introduce new efficiencies that make products not only higher quality, but safer too!

- Sustainability: Similar to the above, traditional manufacturing creates significant waste and is improved via 3D printing. With also fewer parts, and more efficient designs, less energy is used too, creating a more sustainable, healthier and cheaper product.

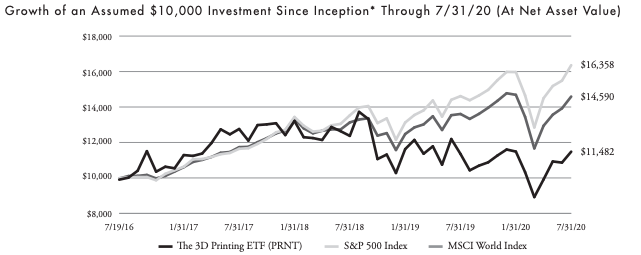

While these are some significant benefits of 3D printing the list keeps going on. We also believe this is still the early innings for the play on 3D printing in general. If you look at the ETF PRNT, that can be used a general barometer for 3D printing, you'll see that the index has actually significantly trailed the growth of the broader market. While this may hurt for existing investors, it signals to us that significant upside still remains!

Now that you understand what 3D printing is and why it is so revolutionary, let's talk about our favorite 3 and the best 3D printing companies to invest in:

- Desktop Metal (DM): DM continues to be our number one stock in the 3D printing space per the above. We still believe that their 2025 expected revenue should be close to $950M (which represents over 100% YoY revenue growth relative to where they are today). Scaling out revenue this much year over year is a task 99% of companies are unable to meet. Scaling 100% a year is easy for young companies but to repeat this at such large numbers would be a massive feat for them! Additionally we also believe 2025 EBITDA to be near $260M (representing net margins of 27%). Again, comparing this to traditional manufacturing, net margins this high signals true underlying changes in the the dynamics of traditional output. If they can scale revenue and keep margins high, we'll be looking at a company who will be dominating manufacturing in a short while!

- Proto Labs Inc. (PRLB): Very similar to DM, we've seen a large sell-off in high growth stocks due to inflation as well as a cut back in general expectations. While the stock has sold off somewhat significantly, we want to reiterate that we believe it will rebound over the LONG TERM. These investments are for those who are looking for multi-year holding periods of disruptive stocks like this that change industries. Additionally, we believe PRLB can be a leader as they've continued to beat estimates QoQ. While not a "true 3D" play, PRLB allows its users to quickly prototype new ideas which will be paramount for bringing new products to market. We see PRLB as a necessary step in the process for design and manufacturing!

- Materialise (MTLS): Throughout the pandemic, people around the world needed PPE and MTLS was there to help manufacture it! With government demand also soaring for 3D printed equipment like ventilators, nasal swabs, and face mask shields MTLS had a huge opportunity to capitalize on the growing need for their product. For MTLS their printers can print parts much more quickly and inexpensively than traditional manufacturing processes and therefore were able to help produce the same product at significantly higher margins! We forecast this should be just the tip of the iceberg for MTLS as they look to expand their use cases now that their market share has increased.

Bonus Pick -> The 3D Printing ETF (PRNT): PRNT is the only pure-play ETF dedicated to the 3D printing ecosystem. The weighting of the ETF is shown below:

- With a majority of the index is skewed towards hardware, PRNT also gives access to the rest of the ecosystem as well. We believe this is a great way to play the general bet on the increased demand in 3D printing rather than just a bet on the right company (e.g. picking the sector rather than picking the sector + company). While the returns will not be as high if you were to select the right company, getting general exposure is a great way to play the overall projected increase. There will be a small fee associated with choosing the ETF, but we believe it is a price well worth paying for!