The Hottest IPO of 2021

Jan 26, 2023Price Target: Unlock 🔐

Target Date: Unlock 🔐

Current Price: $21

Stock: Toast Inc ($TOST)

As the market finds more and more reasons to be hopeful about inflation, let's look into some long-term narratives that will play out if we avoid a steep recession this year.

One of the bigger narratives of the pandemic was the complete collapse of the restaurant and hospitality industry.

2021 and 2022 exacerbated this decline for a whole slew of reasons we've talked about to death.

But even with a potential recession on the table for the first half of 2023, there is still a solid road to recovery for the restaurant industry that can clearly play out into 2024.

Rather than trying to pick winners in that space, let's pull our focus back and find companies that will benefit from a more stable hospitality and service industry.

That's why we're talking about Toast Inc ($TOST) -- the classic SaaS play powering point-of-sale for basically every established restaurant you've been to in the last 6 months.

Toast has been around for over a decade, but only really started hitting its stride as they achieved scale in 2021 and 2022.

Unfortunately, their strong growth has not been in their stock price as macro fears sent investors running to safer plays.

After an IPO at the worst possible time in September of 2021, the stock has dropped more than 50% and spent the last 6 months in really choppy waters.

With a potential recovery coming by the end of the year, this feels like s strong moment to go under the hood at Toast and see if their growth can stick -- making this more of a discount than a long-term indicator of a weaker business.

Long story short, their TAM is massive and they are working hard to break their way into it.

Let's dive into the details 👇

Toast Overview:

Toast is primarily known as a Point of Sale (POS) system for the restaurant industry here in the US.

They've been in competition with folks like Stripe and Square for the better part of the last decade.

While Square and Stripe tried going broad base with their systems -- Toast doubled down on restaurants and restaurants only.

They have strong penetration in the food service space and that's only expanding.

Basically, Toast wins by making it as easy as possible for folks to pay for food and whatever. Their system is top-tier with some strong tech integrations that make the dining experience way more seamless than it used to be.

This results in higher tips for workers, more revenue for owners, a simplified experience for diners, and overall a better-run restaurant. One of the wildest things about Toast is that the product has become so good that a full 1/5th of their new customers come from current-customer referrals, with a full 60% of new customers being sourced by some form of high-intent inbound channels (think: word-of-mouth or equivalent.)

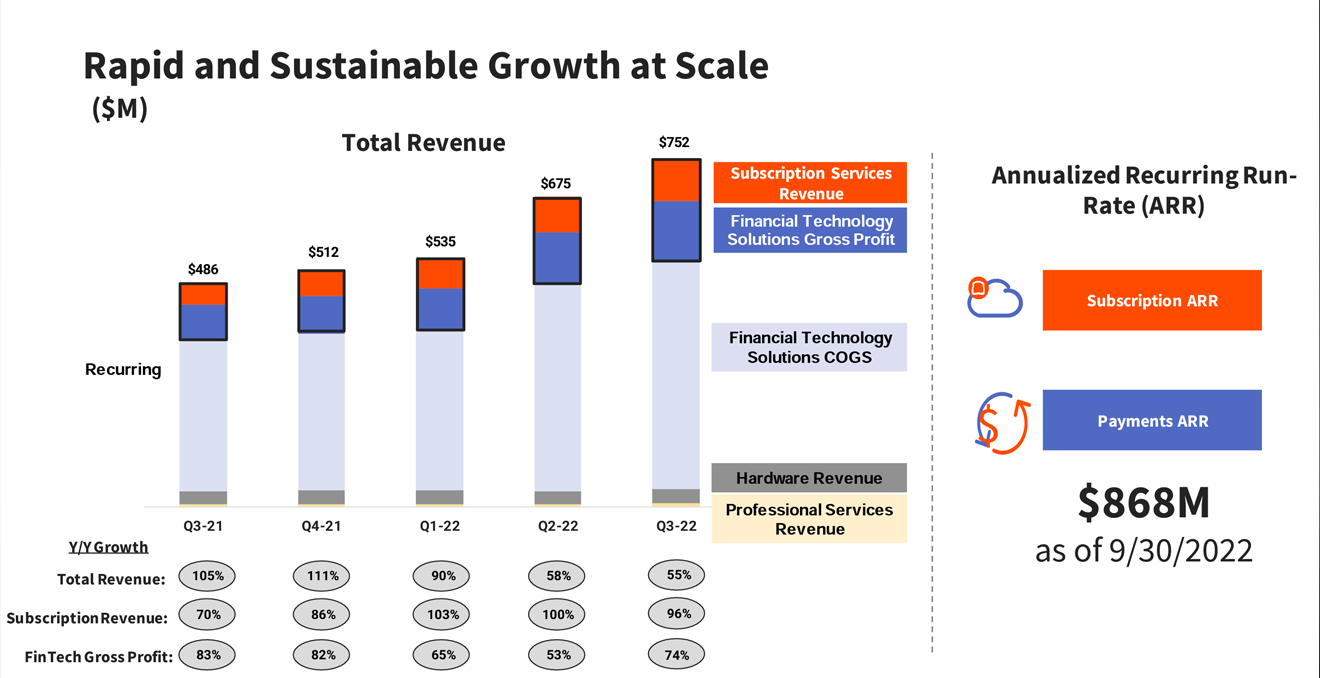

That growth is pretty cheap compared to other SAAS plays and is driving solid results:

And yet the stock is down 50% from its IPO (though up 50% from its 52-week low) and trading choppily to start the year.

So why aren't investors buying this growth?

SaaS is a great business -- but investors treat it like it's an all-or-nothing situation.

If you're winning in your space, you're going to get way overbought. If there is even a hint of competition, you're getting oversold into oblivion.

With concerns about tech layoffs and a recession still looming over the economy -- the market simply isn't ready for a riskier growth play like Toast right now.

Any competitor to TOST can slip in and gain a huge advantage right now and bump them out of the top spot.

Which is why we're watching the stock value stay flat. Folks simply don't know if we're going to get slapped with a full-blown recession or if a TOST competitor can come in and disrupt the disruptor.

But there's another aspect to Toast's growth that's keeping up bullish.

More Customers and More PROFITABLE Customers:

The magic of Toast is that their growth is so fast and so heavily based on word-of-mouth that they are capturing a HUGE swath of new restaurant customers as they open.

As owners open new branches and chefs strike out on their own, Toast is one of the default POS options that folks naturally go with.

If that was the end of the conversation, we'd be very (VERY) skeptical of Toast's growth path from here.

But since Toast has access to those sweet SaaS margins, they can afford to invest a LOT into product development.

Toast has established infrastructure for delivery, marketing, Restaurant Ops, Team Management, and Analytics.

Toast made Point-of-sale so brain-dead easy for restaurant owners that they are having an easy time upselling those successful businesses on a whole slew of other platforms.

The core POS product for Toast is around 10% of the total value a customer COULD represent if they jumped on all of Toast's products.

And that's really encouraging when you look at what happens every time Toast launches a new aspect of their system:

Toast is so wildly effective for their clients that no matter how long they have been customers -- they jump on most upsell opportunities given to them.

Toast's product really started expanding in late 2021 and it simply has not slowed down. Toast's current Average Revenue Per User is about $5,385.

Since most of Toast's new products also increase profitability for their clients -- a recession may not impact this too hard.

Only enterprise plays would cut back costs and stick to legacy systems. Toast increases revenue all around and is a pretty small hit on a restaurant's bottom line.

Plus, services like delivery get small businesses out from under the punishing fees delivery giants like Uber and DoorDash charge, making growth in that department downright explosive.

Because Toast has two main paths to revenue growth, we feel really justified in our short-term bull case.

If Toast achieves modest location growth -- getting to 95,000 locations by EOY 2023 (which, like a lot of our estimates lately is on the way more conservative side) and modestly pump ARPU to ~$5,800 -- that should be enough to stave off the bear sentiment in the market and bring capital flows back to Toast.

Right now TOST's valuation is just way too cheap to pass up.

Long term we can expect them to start really flying when interest rates go down and people start to feel a little more confident about spending.

Toast Outlook:

We'll always like SaaS and their margin-heavy business models.

That growth can sometimes come at a cost (looking at you, Salesforce) but some teams manage that growth really well.

Toast has been responsible for its slower growth strategy and its focus on making a superior product. Word-of-mouth and wildly profitable new products will keep customer growth and average revenue per user growth pushing in the right direction.

This is one of our more aggressive price targets for 2023 -- but this honestly does represent a conservative accounting for their growth.

You can really feel the fear in the markets right now as the street tries to figure out exactly how badly the Fed will pummel the economy going into the bulk of 2023.

Toast's valuation is far too discounted to last.

It may not surge tomorrow, but this is surely a stock with massive long-term potential.

Risk/Reward: Medium-high / Medium

Rating: Overweight

Dividend Yield: 0%

Market Cap: $11.5 Billion