Is This AI IPO a Buy Right Now?

Mar 01, 2023Price Target: Unlock

Current Price: $74

Target Date: Unlock

Stock: GE Healthcare ($GEHC)

Sometimes we get things wrong in the best way.

Last month, we took you through the GE Healthcare IPO (read that post here) and our basic thesis for GEHC was that once they left the greater GE umbrella, they would be able to cut costs and boost margins with better focus.

Well, that has definitely happened. It just happened basically a year before we expected.

That's right, GEHC hit our price target a month after we set it (up 30%), and then posted some truly aggressive growth goals that we have to take seriously.

So, let's take a quick look at GE Healthcare's first earnings call as an independent company and see what's working over there.

Once again, we've got a quick report here while the numbers speak for themselves, so let's just dive into it 👇

Pushing Aggressive Growth:

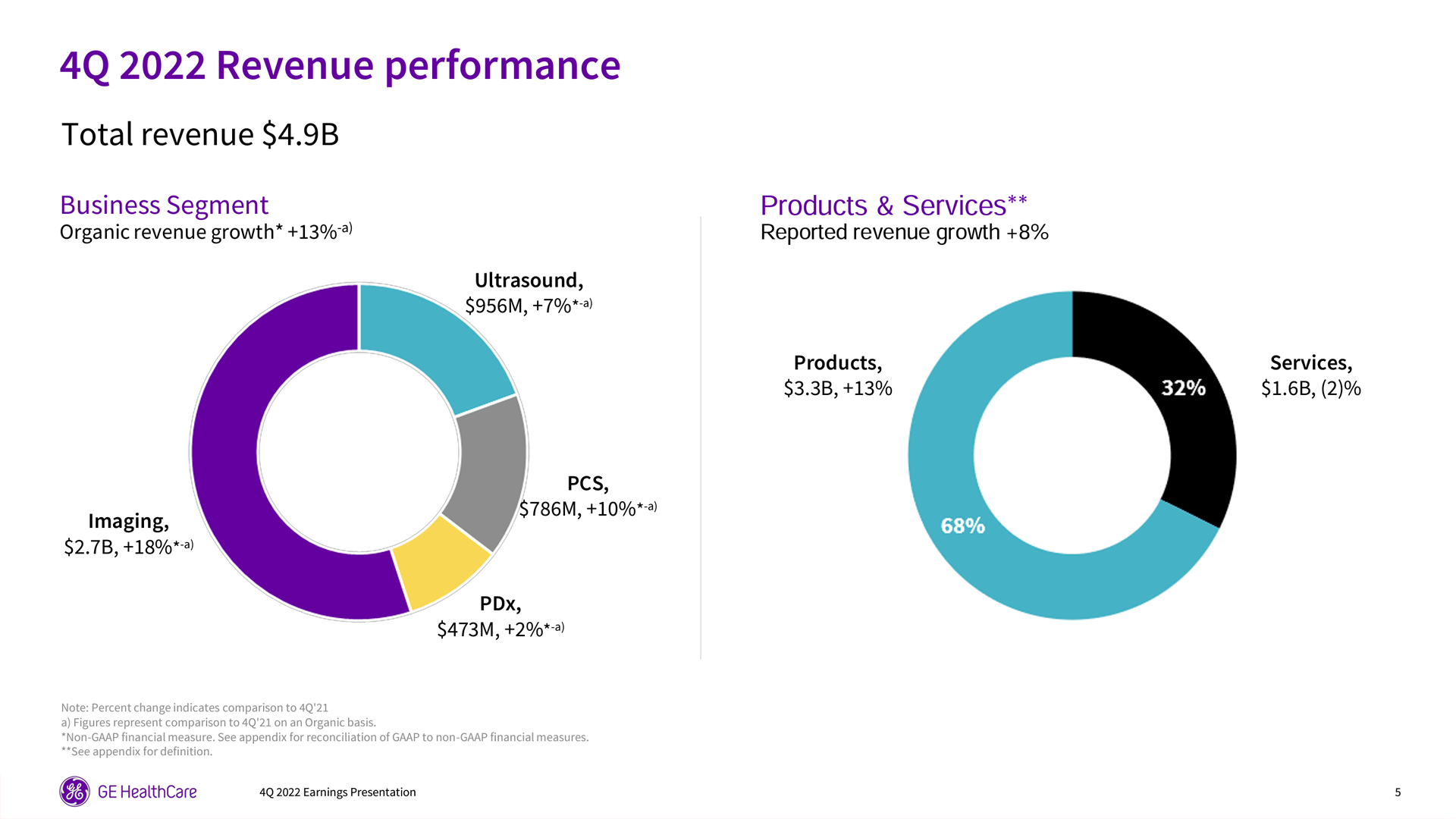

Last month, we were excited that GEHC's organic revenue growth for their biggest segment, imaging, was up 8% YoY.

We based our price target on those segments accelerating a little bit -- but not too much considering that industrial plays like big medical devices will have a slower close time for deals.

But no, GEHC did not accelerate its growth at a modest pace. They more than doubled their revenue growth:

Imaging is up 18% while Ultrasound also expanded to 7%. Precision Care was the wildest growth story as they jumped from 0% growth to 10% growth in a single quarter.

How on earth does something like this happen? There can be some cyclical issues at play here: Big expenses like medical devices usually get saved for later in a fiscal year, and Q4 2021 was also a time of uncertainty for the market and some hospitals may have chosen a more conservative approach.

Furthermore, spending may have been limited to COVID-mitigation processes as Q4 2021 was still a time of surging Covid-19 cases that were hard to manage.

However, all of that simply cannot fully account for how big of a shift this was.

It has to be in conjunction with GEHC's entire strategy as an independent company. GE Healthcare has made AI a pillar of its business, stating that its AI network will allow for far more efficient use cases for all its products -- generating more revenue for its clients.

And since GEHC software can make more money for their customers, it feeds into the second strategic shift happening at the firm.

Crushing Costs:

GEHC announced how they were massively boosting their margins during this last earnings call and the results are frankly jaw-dropping.

While GE Healthcare is still dealing with a multi-year trendline of cost increases thanks to the ongoing supply chain crisis, the team at GEHC made a HUGE step in driving down costs in the last quarter alone:

Furthermore, GE HEalthcare managed to raise prices at a much more accelerated rate in the last quarter as well.

Their AI strategy is working brilliantly while the newly independent structure is allowing them to cut costs in the most efficient way.

We don't anticipate this trend continuing to move this quickly (but hey, we're literally writing this article specifically we've been wrong on this very fact before).

And just seeing it level out and continue for the next two quarters will give us confidence that GEHC has the right idea when it comes to boosting their margins as they massively grow revenue.

GE Healthcare Outlook:

Gosh, we can't be more excited for GE Healthcare.

The medical device industry is booming, and just like yesterday's post on Palo Alto Networks, GEHC is in a position to capitalize on the current state of the AI market to cut costs and raise revenues across the board.

They're never going to hit anything like a SaaS multiple--but once GEHC restructures enough to find their true level, they will be a strong defensive play that can bolster your portfolio regardless of the situation.

Management has absolutely crushed it so far, we can't wait to see just how far they can push this thing.

Rating: Overweight

P/E Ratio: 17x

Market Cap: $33B

Dividend Yield: N/A