Is This Stock Massively Undervalued?

Feb 22, 2023Price Target: Unlock

Current Price: $288

Target Date: Unlock

Stock: Rockwell Automation ($ROK)

Since the last time we reported on Rockwell Automation ($ROK), check out our initial report here, the stock has gone on an absolute tear and beaten our price target 6 months ahead of schedule.

Our entire thesis was based on reshoring in the United States. What we didn't anticipate was a broader reshoring trend that is starting to materialize worldwide.

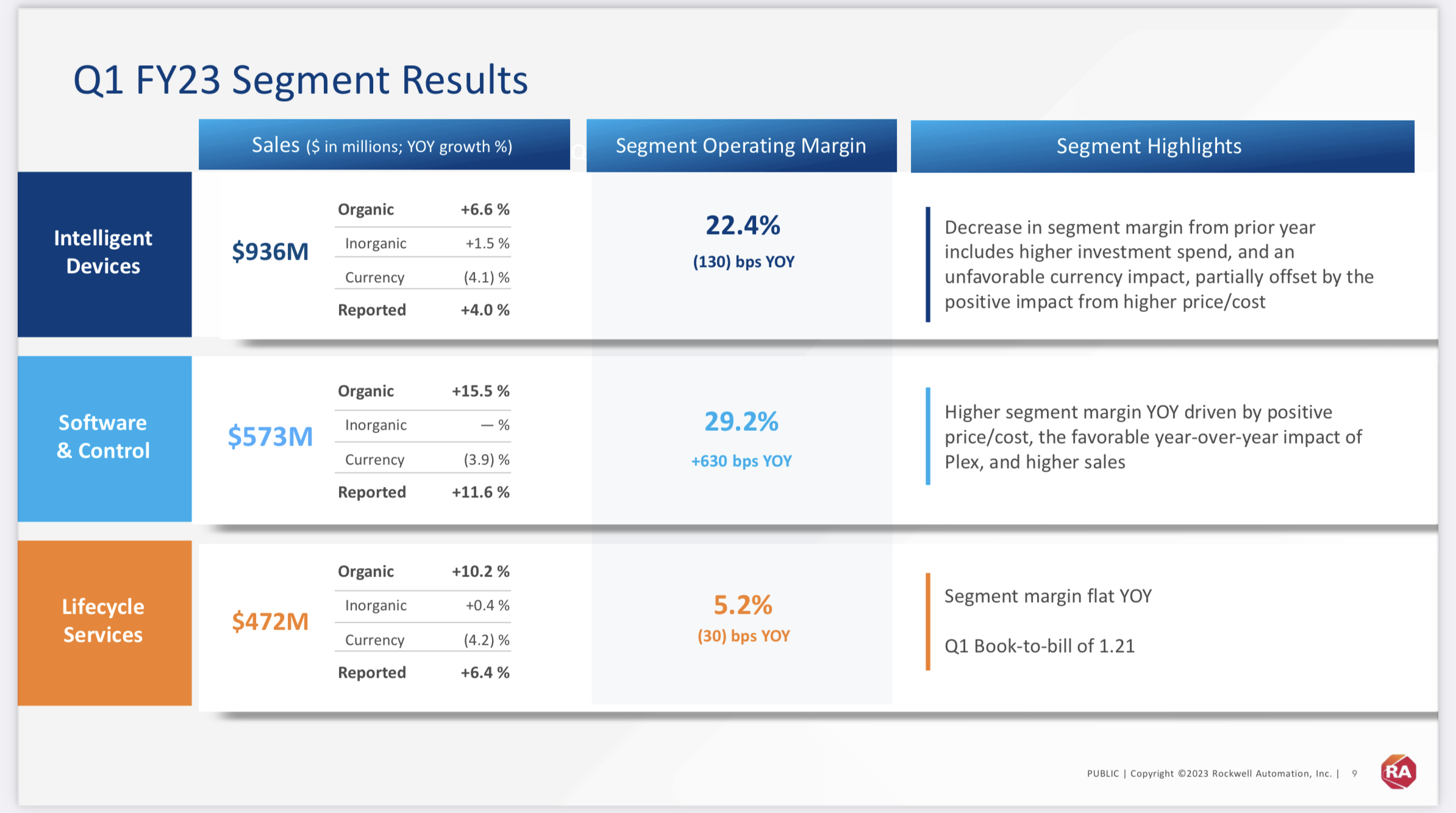

Rockwell has posted back-to-back barn-burner earnings, and that's why we are ready to boost our price target for 2023.

The only major area of concern we see is an uptick in competition as more and more firms line up to get a slice of the over $300 billion in investment being made for US manufacturing right now.

But with a massive backlog and proven track record, we don't see Rockwell being particularly threatened by competition.

We see a company that is brilliantly iterating and gearing up to dominate a new era of manufacturing as it makes its way back to the US.

We'll make this another quick one as the numbers largely speak for themselves. Let's get into it 👇

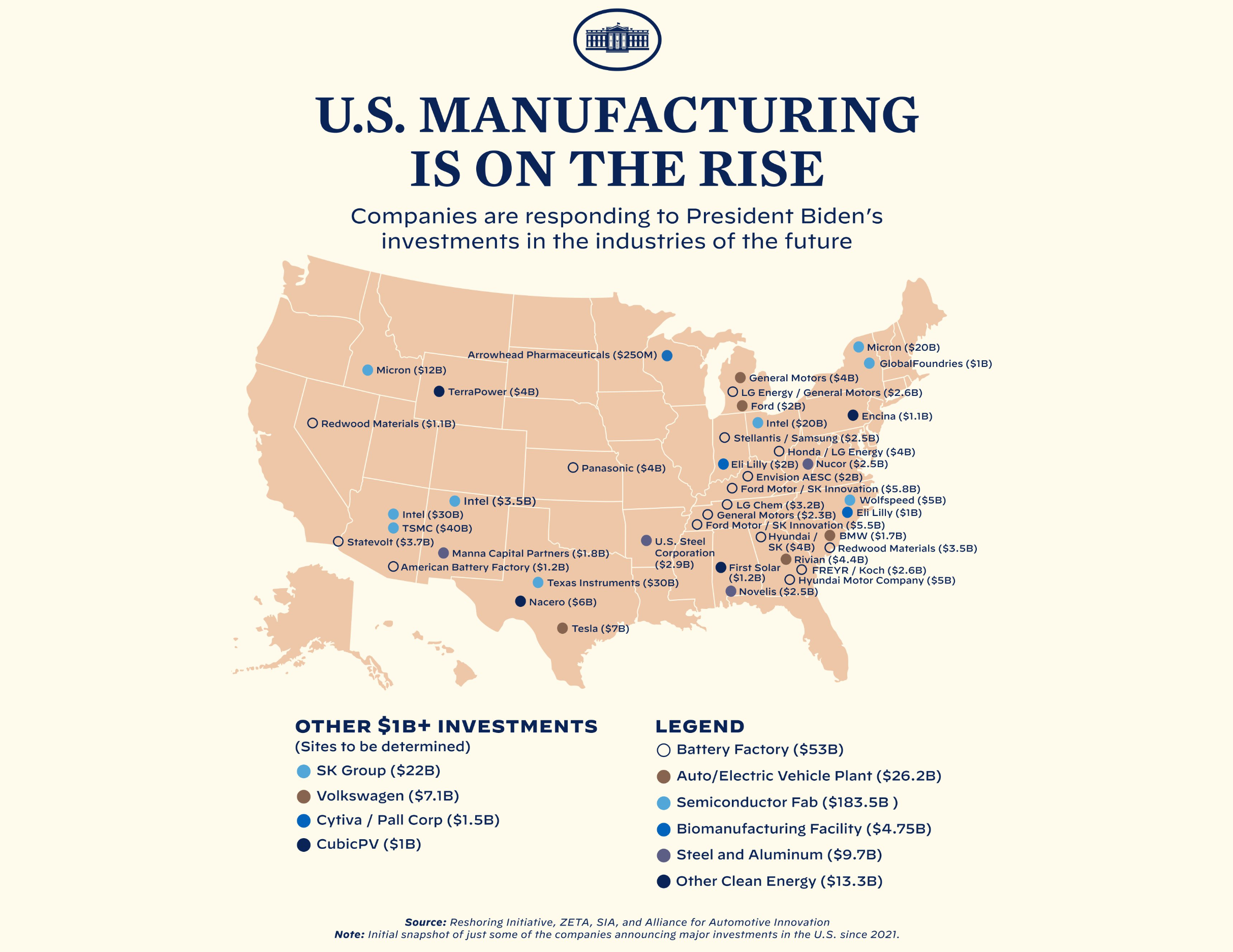

US Manufacturing is EXPLODING:

The last year has been WILD for the US economy as more and more investment is pouring into new manufacturing projects.

With the Inflation Reduction Act, a lot of the manufacturing is centering around complex industries like EVs, batteries, and solar panels.

This is great for Rockwell, as a large portion of their automation services centers around more complex processes like automotive.

With all this reshoring happening in the US (and abroad too -- but we'll get into that in a second) the main thing we're looking for is companies setting automation as a line item as they start reporting on how they are distributing their funds for these projects.

The chief cost of reshoring is labor and some estimates are setting aside a full 30% of the investment in those new manufacturing projects for labor alone.

Rockwell and other automation companies have a unique opportunity to really make all that investment walk a little harder and push a little further.

But we need a little more data from these projects before we can confidently say Rockwell can explode off of this investment.

But with ongoing support for the Inflation Reduction Act -- these numbers are set to rise.

Rockwell has automation processes for all the major industries listed in the chart above -- giving them a big advantage.

This is a huge pie to cut into and we're already starting to see a huge amount of competition kick up for it.

We'd honestly be worried if it weren't for:

Rockwell's INCREDIBLE Backlog:

ROK is honestly selling like hotcakes, and while we're seeing their deals pipeline slow down a bit, they have enough revenue planned out to keep them going until 2025.

Again, the big thing with Rockwell is growing their company so they can serve all this demand.

Looking at their last two earnings calls, we haven't seen them balloon costs at all.

Heck, most of their backlog is so locked in that we could see a full-on recession and it wouldn't slow down execution or revenue for Rockwell until late 2024.

Rockwell is in an incredible position and they are pacing their growth in the exact right way.

Rockwell Outlook:

Rockwell is really the perfect company to tackle the perfect opportunity at the perfect time.

There really isn't that much to add.

We're excited to see them keep pressing their automotive and semiconductor verticals so they can maintain their dominance and grow their operations as fast as possible to keep up with their backlog.

Supply issues are here to stay and it looks like other countries have caught on to this.

There's one more piece that gives us solid confidence going into the next year for Rockwell, and that's just how much they have secured worldwide contracts for their processes:

We are stunned to see Rockwell going so fast in places outside of America.

It's really encouraging that we're seeing this level of revenue growth from ROK BEFORE the macro and Forex environment cools down a bit.

As soon as the dollar starts weakening again, Rockwell's revenues are going to spike even more.

All the flywheels are in place. This is just a matter of sitting back and watching the magic happen.

Rating: Overweight

Market Cap: $33B

Dividend Yield: 1.6%

Risk / Reward Profile: Medium / Medium-High